Cryptocurrency in India is a hot topic for traders and investors. Not just because of the popular tweets by Elon Musk, but also because of the wealth it has created (and destroyed) for crypto traders. In this article, we take a look at Cryptocurrency in India and its current situation. Keep Reading.

What is Cryptocurrency?

Cryptocurrencies are decentralized forms of virtual currency that are very popular and highly secured by cryptography. They are systems that enable people to make secure payments online and are based on Blockchain technology — a distributed ledger system enforced by an extensive and intertwined network of computers. The word cryptocurrency is derived from the encryption algorithms and techniques that are used to secure the network. Examples of such cryptographic techniques include elliptical curve encryption, public-private key pairs, and hashing functions.

Although cryptocurrencies are very popular forms of currency, they also have a lot of controversy surrounding them due to the fact that, unlike Dollars, Euros, or Rupees, cryptocurrencies are generally not issued by Governments or any other central authority which renders them immune to manipulation, or Government interventions. Hence, they face criticism because experts have claimed that cryptocurrencies are being used as a medium of exchange to finance illegal activities.

Their exchange rates are very volatile, and also the roots of blockchain and crypto infrastructure are questionable. Experts also believe that cryptocurrencies may become obsolete in the near future, thus stating that owners might have to be prepared to lose their money due to the loss in value and also that they are disrupting industries such as Finance and Law.

Now looking at the bright side, cryptocurrencies, despite the negative buzz and speculations surrounding them, have plenty of benefits that owners enjoy and the reasons why they are highly preferred forms of currency are:

1. Cryptocurrencies are well-protected by blockchain technology, which ensures data protection as well as the privacy of transactions. Hackers will not be able to manipulate or steal data from the network because of its strong encryption and also that they would require a private key to access someone else’s data.

2. They are more decentralized forms of payment, promoting self-management since cryptocurrencies are not under the authority and regulation of any Govt or legal institution.

3. Cryptocurrencies are immune to inflation because the only thing that can affect them is demand. The Government and economic status do not affect them, and an increase in demand will only increase their value, limiting the risk of inflation.

4. Cryptocurrencies enable quicker transfer speeds when conducting transactions, and most significantly, the transaction fees are also very low since there are no third parties involved to verify them. Taking the example of Bitcoin, users can save between 0.5% to 5% along with a 20–30% flat fee for each transaction made.

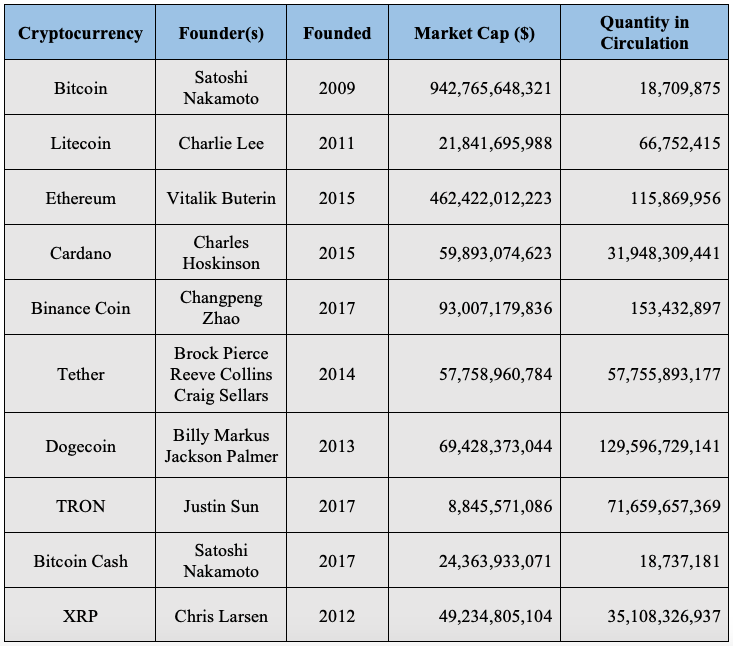

The scope of cryptocurrencies has grown over the years and so are the number of crypto holders and investors. Currently, there are over 106 million people worldwide who are actively owning and using cryptocurrencies. One of the most popular and predominant cryptocurrencies is Bitcoin, which was launched in 2009 by Australian entrepreneur Craig Wright under the pseudonym “Satoshi Nakamoto” during the subprime crisis.

Bitcoins are highly valued currencies with a total market cap of $942 billion and also there are over 18.7 million bitcoins in circulation around the world. The aggregate value of all cryptocurrencies in existence is approximately $1.5 trillion, where Bitcoin represents more than 60% of the total value. However, the value of bitcoin plunged 17% on 13th May 2021 due to Elon Musk, the world’s second-richest man and founder of Tesla Inc., stating that his automaker will not be accepting bitcoins as a mode of payments anymore due to environmental concerns. Thus, in under two hours of making that tweet on Twitter, the price of Bitcoin dropped down drastically from $54,819 to $45,700.

At present, Bitcoin and Ethereum are very popular cryptocurrencies. Just recently, Dogecoin also reached a high level of popularity and recognition when it reached a market cap of a whopping $78 billion in May. This cryptocurrency was only created as a joke, but Tesla CEO Elon Musk praised the idea behind the creation of Dogecoin and also accepted it as a mode of payment in his company, which boosted Dogecoin’s value drastically.

Aside from the three, there are over 6,000 different kinds of cryptocurrencies being traded worldwide and below are ten popular examples that are trending and have a higher scope for growth.

Blockchain Technology Explained

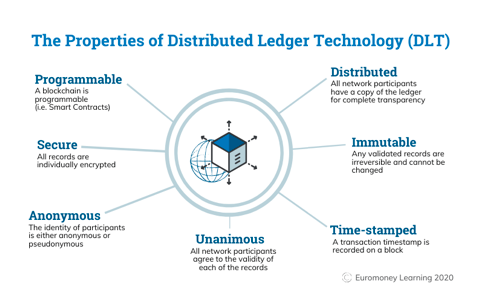

A Blockchain is an open-ended and decentralized distributed ledger that records cryptocurrency transactions in a coded format. The transaction records are duplicated and distributed across various computer networks which are in the blockchain. The records are stored within a ‘block,’ and these blocks are linked together on a chain with other blocks that contain preceding cryptocurrency transactions.

Blockchain Technology is a form of Distributed Ledger Technology because it is a decentralized database being managed by multiple participants and its functioning can be compared to that of a checkbook, where everyday transactions are recorded and each page in that book is the same as each block in a blockchain.

Every time someone makes a transaction using cryptocurrency, the software makes a record of the transaction and stores them in each block. The main purpose behind the blockchain is to ensure that there is integrity within the system and to provide protection against hacking, thefts, and altering of the system. Every transaction in a blockchain is hence recorded with a permanent cryptographic signature called a ‘hash.’

At present, Blockchain Technology and cryptocurrencies are being considered the future of modern technology, which will revolutionize business practices as well as payment methods. By 2030, it is expected that the value-added in businesses by blockchain will exceed $3.1 trillion.

The scope for DLT growth is high all around the world because 86% of the top executives believe that blockchain will become mainstream eventually because global spending on that in 2019 was $2.7 billion, an 80% increase compared to 2018. Moreover, blockchain technology is performing an incredible job in ensuring efficiency, transparency and also, elimination of corruption within the system. There won’t be any middlemen involved and hence, it will promote effective and smooth P2P transactions.

According to the International Data Corporation (IDC), investments in the blockchain were expected to grow at a robust pace throughout 2018–2023 with a CAGR of 60.2% and the technology is growing so fast. According to a survey conducted by Deloitte, 61% of US citizens, 47% of Chinese citizens, and 54% of Singapore citizens have agreed that blockchain will definitely achieve mainstream adoption.

Rules and Regulations for Cryptocurrencies in India

As mentioned previously, cryptocurrencies are not issued by the Government and this is the central reason why individuals think that investing in cryptocurrencies is very risky and possibly, even illegal.

In March 2021, the Government of India also stated that they would be banning the use of cryptocurrencies, although it wasn’t confirmed whether crypto owners would be compensated for having to give up their assets in case the ban is imposed.

As of now, investing in cryptocurrencies is legal, but there is no regulatory framework for them. Unlike stock exchanges that are regulated by the Securities Exchange Board of India (SEBI), cryptocurrency exchanges do not have any regulatory bodies. Therefore, without proper rules and regulations, it is in fact risky to invest in cryptocurrencies as investors will not get any protection against frauds, thefts, and other external factors.

When we analyze the situation in India, the Government at present stated that they were open to exploring cryptocurrencies as well as blockchain technology’s potential. However, until a bill is passed and a regulatory framework is established, cryptocurrencies are not allowed to be used as legal tender in India.

Although exchanges are legal, still people are not allowed to use cryptocurrencies as a mode of payment for transactions. Also due to the lack of clarity of the tax status of cryptocurrencies, the chairman of the Central Board of Direct Taxation (CBDT) stated that individuals profiting from Bitcoins should be taxed and other income tax department sources have suggested that they should be taxed as capital gains.

The Reserve Bank of India (RBI) has also been a major player in cryptocurrency dealings. On 14th January 2018, RBI had banned banks and other regulated financial institutions from conducting any sort of business activity using cryptocurrency and it also confirmed that it had not issued any licenses or authorizations to any company to make such dealings and also warned that if they did, they would be required to exit their positions. Exchanges were given time till 6th July 2018 to shut down, but in 2020, a landmark supreme court ruled the ban unconstitutional and hence, reversed the prohibition and allowed exchanges to reopen.

Right now considering the popularity of cryptocurrencies, especially Bitcoin and Dogecoin, there are plenty of investors who are looking to invest in them and this has increased their scope in India. Currently, the Government is under the process of framing policies and regulations for cryptocurrency investments and so with the progress of time, cryptocurrencies may be accepted as legal tender only for specific transactions.

Taxation of Bitcoins in India

Since the concept of bitcoins and cryptocurrencies are quite new in India, the Government has not yet brought the taxability of bitcoins into their statute books. But even then, taxation on cryptocurrencies cannot be ruled out according to the income tax laws, because every source of income needs to be taxed, regardless of how the income has been earned. To make this simpler, the possibilities of how bitcoins are taxed can be seen as follows:

1. In a scenario where bitcoins are mined, they become self-generated capital assets. The sale of such bitcoins will subsequently become capital gains. However, being a self-generated asset, there is no cost of acquisition involved and not falling under Section 55 of the Income-tax Act, 1961, which specifically defines the cost of acquisition of certain self-generated assets, capital gain tax will not arise out of bitcoin mining.

2. When bitcoins are purchased through an exchange and held on a long-term basis, the appreciation value would give rise to long-term or short-term capital gain, depending on the duration of holdings. Hence, long-term gains would be taxed at a flat rate of 20%, while short-term gains have an individual slab rate.

3. In a situation where bitcoins are being traded like stocks in crypto exchanges, it would also give rise to income from capital gains, which will also be taxed as per individual slab rates.

Due to the lack of clarity on how bitcoins are to be taxed, the Government of India along with the Reserve bank of India are still working and screening new policies and tax regulations for cryptocurrencies. Since they are not allowed to be used as legal tender when conducting transactions, the levying of tax is negated from this.

But we can see that bitcoin miners can evade taxes and non-miners who have invested in bitcoin will have to pay a certain amount of tax for their gains. In time, it is prominent that the Government will come up with a regulatory framework for cryptocurrencies, thus allowing them to be used more widely in business.

How to Acquire Cryptocurrency?

People who are interested to own cryptocurrencies have three different ways by which they can acquire them. The first method is Bitcoin Mining. This is the process where new bitcoins are entered into circulation and to mine bitcoins, sophisticated computers are used to solve extremely complex math problems.

This method is usually very cumbersome, expensive, and time-consuming, but if done right and successfully, can be extremely rewarding. Miners receive bitcoin or other cryptocurrencies as a reward for completing blocks of verified transactions that are finally added to the blockchain. Through this method, miners can actually earn cryptocurrencies without having to put any money forth and the only investment required would be for a high-spec computer with the software to conduct the mining process.

At present, there are over 1 million bitcoin miners and there have also been some cases where miners and investors acquired cryptocurrencies and conducted transactions using them through the ‘dark web.’

The main disadvantage of this method is that mining can only be done by individuals with advanced computer knowledge and coding skills, and hence it is not a method anyone can use to acquire cryptocurrency. However, investors can actually buy cryptocurrencies through exchanges.

Unlike stock exchanges, cryptocurrency exchanges are self-regulated and function 24/7. It is the easiest way to buy cryptocurrencies and all a customer has to do is register themselves on an exchange, complete the KYC procedure by giving their Aadhar and PAN details for verification. After the verification is complete, customers can link their bank accounts, deposit funds, and buy cryptocurrencies. Investors can now buy and maintain cryptocurrency wallets through the following exchanges:

- Binance

- Kraken

- Coinbase

- eToro

- WazirX

- Coinmama

- CoinDCX

Last but not least, the third method which could be used is P2P transactions. In case an investor is not interested to pay transaction fees or sign up through corporate platforms, he/she can look for a seller who is interested in the purchase and close the deal.

The exchanges will act as facilitators during the transaction. However, it would be difficult to match with the right seller and also P2P transactions tend to take time.

Conclusion

From this article, we can understand how cryptocurrencies have revolutionized the process of conducting transactions as well as the rising popularity of Bitcoin, Ethereum, and Dogecoin. Blockchains play a vital role in the workings of cryptocurrency transactions and they have been successful ever since in protecting the sanctity of transactions and keeping records of them.

We also know that Bitcoin is the primary and most popular cryptocurrency with the highest market cap and also constitutes over 60% of the total value of all cryptocurrencies put together. It has a very high potential for growth and in the near future, it could be accepted as legal tender in many countries.

Companies are integrating blockchain technology into their business practices and, thus it will pave way for cryptocurrencies to enter into the business world.

Also Read: Looking for breaking headlines & latest news from the Europe UK? europeanbusinessmagazine brings you live daily news about European parliament, economy & current events.