Synopsis– Flight delays and cancellations have continued to burden India’s aviation sector, causing heavy operational and financial losses for the leading carriers of the country, like IndiGo, Air India Group, SpiceJet, and Akasa Air. This article highlights how rising costs, disrupted schedules, and declining passenger confidence remind us about the urgent need for improved on-time performance and infrastructure upgrades.

Flight delays and cancellations remain to be a significant challenge for the Indian aviation industry, which has caused substantial financial and operational losses to the country’s major commercial airlines. Looking at the latest statistics from the Directorate General of Civil Aviation (DGCA) report from July 2025, traffic report, and complementary industry insights. This article is going to provide a comprehensive overview of the losses incurred by prominent Indian airlines such as Air India Group, IndiGo, SpiceJet, Akasa Air, and other major players due to flight delays and operational disruptions.

Passenger Traffic and Market Landscape in 2025

In 2025, domestic airlines in India carried about 977.79 lakh passengers, which marks a healthy annual growth of 5.9% over the 923.35 lakh passengers in the same period last year. Despite this clear growth, passenger movement fell by 2.94% in July 2025 when compared to the previous months of 2025. This reflects a cooling trend, partly that is being driven by cancellations and delays.

The market share distribution continues to be dominated by IndiGo, which holds roughly 64.4%, followed by the Air India Group with approximately 26.7%, Akasa Air at 5.1%, and SpiceJet with a 2.7% share. Maintaining a strong market presence is important, however, this does not shield an airline from the operational and financial damage that could arise from flight delays.

Flight Delays, Cancellations and On-Time Performance

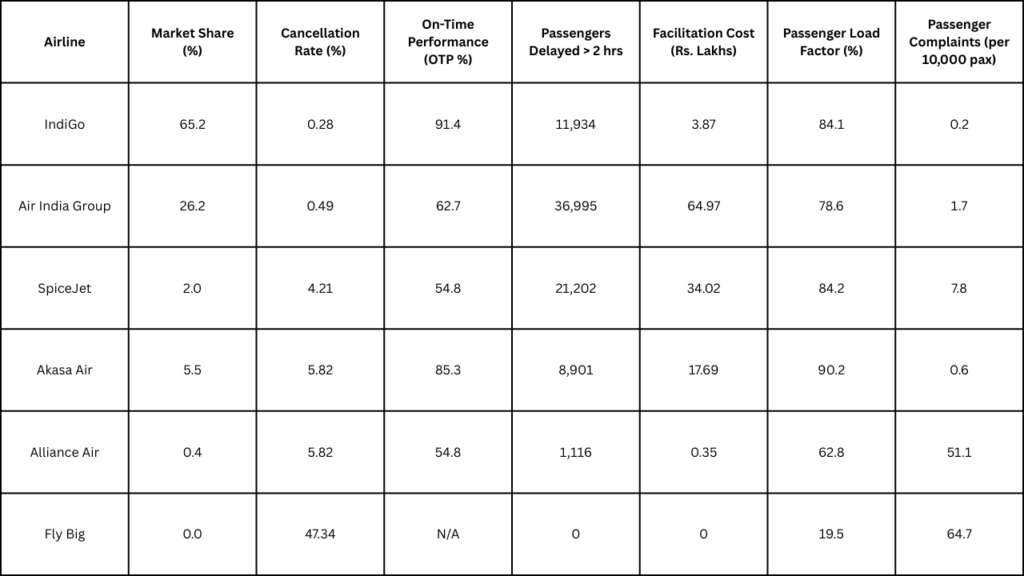

The overall cancellation rate in July of 2025 was recorded at 0.81%. Where Fly Big witnessed a massive 47.34% cancellation rate, and is followed by Alliance Air’s 5.82% and SpiceJet’s 4.21%. While other major airlines such as IndiGo and the Air India Group exhibited a lower cancellation rate of 0.28% and 0.49% respectively, though delays still remain as a challenge across the board.

On-Time Performance (OTP), which is a critical metric that indicates punctuality, further underscores delays:

- IndiGo showcases a high OTP of 91.4% at major metro city airports.

- Akasa Air follows closely with 85.3%.

- Air India Group lags significantly at 62.7%.

- SpiceJet and Alliance Air report 54.8% and lower OTP, indicating widespread delay issues.

Airport-level data shows Air India Group OTP as low as 45.3% at Delhi and 57.1% at Mumbai, two key aviation hubs, illustrating serious punctuality challenges that exacerbate delays and losses. Most delays stem from “reactionary” causes (62%), which occur when late arrivals of aircraft cause subsequent late departures. Other key reasons include air traffic control restrictions (10%), operational issues (9%), and technical faults (7%).

Economic Impact: Quantifying the Losses

Compensation and Facilitation Costs: Flight delays and cancellations trigger significant compensation and facilitation costs for Indian airlines. Under DGCA’s Civil Aviation Requirements (CAR), airlines must provide passengers with refreshments, accommodation, alternate flights, or refunds based on delay duration.

In July 2025 alone:

- Air India Group facilitated over 36,900 delayed passengers and spent approximately Rs. 64.97 lakhs on refreshments, accommodations, and alternate travel arrangements.

- IndiGo managed around 11,934 delayed passengers with facilitation costs of roughly Rs. 3.87 lakhs for alternate flights and travel vouchers.

- SpiceJet attended to 21,202 delayed passengers, allocating Rs. 34.02 lakhs for refreshments and alternate flights.

- Akasa Air and Alliance Air also faced facilitation expenses totaling Rs. 17.69 lakhs and Rs. 0.35 lakhs, respectively.

- Across all major airlines, nearly 82,937 passengers were delayed beyond two hours, incurring a cumulative facilitation cost of Rs. 119.69 lakhs in July alone.

Also read: Top 10 Countries of Birth for Approved H-1B Visa Beneficiaries

Operational Costs and Revenue Loss

Delays have inflated operational costs in fuel consumption, which is due to the holding patterns and rerouting, crew overtime payments, and maintenance. The closure of Pakistani airspace and geopolitical tensions in 2025 forced flights to reroute more, which further increased the fuel cost, specifically for Air India’s international routes, causing tens of crores in losses. Additionally, passenger dissatisfaction from frequent delays has translated to lost revenues from diminished bookings and brand erosion. The Indian aviation industry’s overall net losses in FY26 are forecast to rise to Rs. 9,500-10,500 crores, with delays being a significant contributor amid other headwinds like soaring fuel prices.

Passenger Complaints Reflect Operational Strains

In July 2025, airlines received 1,257 passenger complaints, predominantly related to flight problems (30.3%) and refund delays (19.5%). Air India Group had the highest complaint count at 575, followed by SpiceJet with 191 complaints. Impressively, 99.9% of complaints were resolved, reflecting a concerted effort by airlines to manage passenger grievances despite ongoing operational difficulties.

Passenger Load Factors and Utilization: Load factors remained generally high, indicating strong demand despite delays

- IndiGo and Akasa Air consistently maintained a load factor above 80% in July 2025.

- Air India Group’s load factor dipped from 81.5% in June to 78.6% in July, possibly reflecting the impact of delays and cancellations on passenger confidence and scheduling efficiency.traffic-Data-July-25.pdf

Conclusion

Flight delays in India cause multifaceted losses running into hundreds of crores annually. The July 2025 data reveals just how deeply delays impact finances—Air India Group alone spent nearly Rs. 65 lakhs in passenger facilitation, while total compensation and facilitation costs across major carriers touched Rs. 1.83 crore in a single month.

Although IndiGo and Akasa Air have shown better punctuality and lower cancellation rates when compared to all the airlines, where all of them have faced the common challenges- from regulatory hurdles to reactionary delays. To minimise these kinds of losses, airlines and regulatory bodies must prioritize on infrastructure enhancement, streamline air traffic management, and even reinforce compliance with operational schedules.

By just improving the on-time performance, an airline is not only going to enhance profitability but will also be able to restore passenger confidence, which is a key point for sustaining the growth of the Indian civil aviation sector.

Written by Adithya Menon