List of Must Know Financial Ratio Analysis for Stock Market Investors: Evaluating a company is a very tedious job. Judging the efficiency and true value of a company is not an easy task it demands rigorously reading the company’s financial statements like balance sheets, profit, and loss statements, cash-flow statements, etc.

Since it is tough to go through all the information available on a company’s financial statements, investors have found some shortcuts in the form of financial ratios. These financial ratios are available to make the life of a stock investor comparatively simple. Using these ratios, stock market investors can choose the right companies to invest in or can compare the financials of two companies to find out which one is a better investment opportunity.

In this post, we are going to discuss eight such Financial Ratio Analyses that Every Stock Investor Should Know.

This article is divided into two parts. In the first part, we’ll cover the definitions and examples of these eight must-know financial ratios. In the second part, after the financial ratio analysis, we’ll discuss how and where to find these ratios. Therefore, be with us for the next 8-10 minutes to enhance your stock market analysis knowledge. Let’s get started.

Quick note: Do not worry much about calculations of these ratios or try to mug up the formulas by-heart. All these financial ratios are easily available on various financial websites. Nonetheless, we will recommend you to understand the basics of the financial ratio analysis as it will be helpful in building a good foundation for your stock research in future.

Table of Contents

PART A: 8 Financial Ratio Analysis For Stock Investors

1. Earnings Per Share (EPS)

EPS is the first and most important ratio on our list. It is very important to understand Earnings per share (EPS) before we study any other ratios, as the value of EPS is also used in various other financial ratios for their calculation.

EPS is basically the net profit that a company has made in a given time period divided by the total outstanding shares of the company. Generally, EPS can be calculated on an annual basis or Quarterly basis. Preferred shares are not included while calculating EPS.

Earnings Per Share (EPS) = (Net income – Dividends from preferred stock)/(Average outstanding shares)

From the perspective of an investor, it’s always better to invest in a company with higher and growing EPS as it means that the company is generating greater profits. Before investing in any company, you should always check past EPS for the last five years. If the EPS is growing for these years, it’s a good sign and if the EPS is regularly falling, stagnant or erratic, then you should start searching for another company.

2. Price to Earnings (PE) Ratio

The Price to Earnings ratio is one of the most widely used financial ratio analyses among investors for a very long time. A high PE ratio generally shows that the investor is paying more for the share. The PE ratio is calculated using this formula:

Price to Earnings Ratio= (Price Per Share)/( Earnings Per Share)

Now let us look at the components of the PE ratio. It’s easier to find the price of the share which is the current closing stock price. For the earnings per share, we can have either trailing EPS (earnings per share based on the past 12 months) or Forward EPS i.e. Estimated basic earnings per share based on a forward 12-month projection. It’s easier to find the trailing EPS as we already have the result of the past twelve month’s performance of the company.

For example, a company with a current share price of Rs 100 and EPS of Rs 20, will have a PE ratio of 5. As a thumb rule, a low PE ratio is preferred while buying a stock. However, the definition of ‘low’ varies from industry to industry.

Different industries (Ex Automobile, Banks, IT, Pharma, etc) have different PE ratios for the companies in their industry (Also known as Industry PE). Comparing the PE ratio of the company of one sector with the PE ratio of the company of another sector will be insignificant. For example, it’s not much use to compare the PE of an automobile company with the PE of an IT company. However, you can use the PE ratio to compare the companies in the same industry, preferring one with low PE.

3. Price to Book (PBV) Ratio

The price to Book Ratio (PBV) is calculated by dividing the current price of the stock by the book value per share. Here, Book value can be considered as the net asset value of a company and is calculated as total assets minus intangible assets (patents, goodwill) and liabilities. Here’s the formula for the PBV ratio:

Price to Book Ratio = (Price per Share)/( Book Value per Share)

PBV ratio is an indication of how much shareholders are paying for the net assets of a company. Generally, a lower PBV ratio could mean that the stock is undervalued.

However, again the definition of lower varies from industry to industry. There should be an apple-to-apple comparison while looking into the PBV ratio. The price-to-book value ratio of an IT company should only be compared with PBV of another IT company, not any other industry.

4. Debt to Equity (DE) Ratio

The debt-to-equity ratio measures the relationship between the amount of capital that has been borrowed (i.e. debt) and the amount of capital contributed by shareholders (i.e. equity).

Debt to Equity Ratio =(Total Liabilities)/(Total Shareholder Equity)

Generally, as a firm’s debt-to-equity ratio increases, it becomes riskier as it means that a company is using more leverage and has a weaker equity position. As a thumb of rule, companies with a debt-to-equity ratio of more than one are risky and should be considered carefully before investing.

5. Return on Equity (ROE)

Return on equity (ROE) is the amount of net income returned as a percentage of shareholders’ equity. ROE measures a corporation’s profitability by revealing how much profit a company generates with the money shareholders have invested. In other words, ROE tells you how good a company is at rewarding its shareholders for their investment.

Return on Equity = (Net Income)/(Average Stockholder Equity)

As a thumb rule, always invest in a company with ROE greater than 20% for at least the last 3 years. Year-on-year growth in ROE is also a good sign.

6. Price to Sales Ratio (P/S)

The stock price/sales ratio (P/S) ratio measures the price of a company’s stock against its annual sales. The P/S ratio is another stock valuation indicator similar to the P/E ratio.

Price to Sales Ratio = (Price per Share)/(Annual Sales Per Share)

The P/S ratio is a great tool because sales figures are considered to be relatively reliable while other income statement items, like earnings, can be easily manipulated by using different accounting rules.

7. Current Ratio

The current ratio is a key financial ratio for evaluating a company’s liquidity. It measures the proportion of current assets available to cover current liabilities. The current ratio can be calculated as:

Current Ratio = (Current Assets)/(Current Liabilities)

This ratio tells the company’s ability to pay its short-term liabilities with its short-term assets. If the ratio is over 1.0, the firm has more short-term assets than short-term debts. But if the current ratio is less than 1.0, the opposite is true and the company could be vulnerable. As a thumb rule, always invest in a company with a current ratio greater than 1.

8. Dividend Yield

A stock’s dividend yield is calculated as the company’s annual cash dividend per share divided by the current price of the stock and is expressed in annual percentage. Mathematically, it can be calculated as:

Dividend Yield = (Dividend per Share)/(Price per Share)*100

For Example, If the share price of a company is Rs 100 and it is giving a dividend of Rs 10, then the dividend yield will be 10%.

A lot of growing companies do not give dividends, but rather reinvest their income in their growth. Therefore, it totally depends on the investor whether he wants to invest in a high or low-dividend-yielding company. Anyways, as a thumb rule, a consistent or growing dividend yield is a good sign for dividend investors.

PART B: Finding Financial Ratios

Now that we have understood the key financial ratio analysis, next we should move toward where and how to find these financial ratios.

For an Indian Investor, many big financial websites where you can find all the key ratios mentioned above along with other important financial information. For example – Money Control, Yahoo Finance, Economic Time Markets, Screener, Investing[dot]com, Market Mojo, etc.

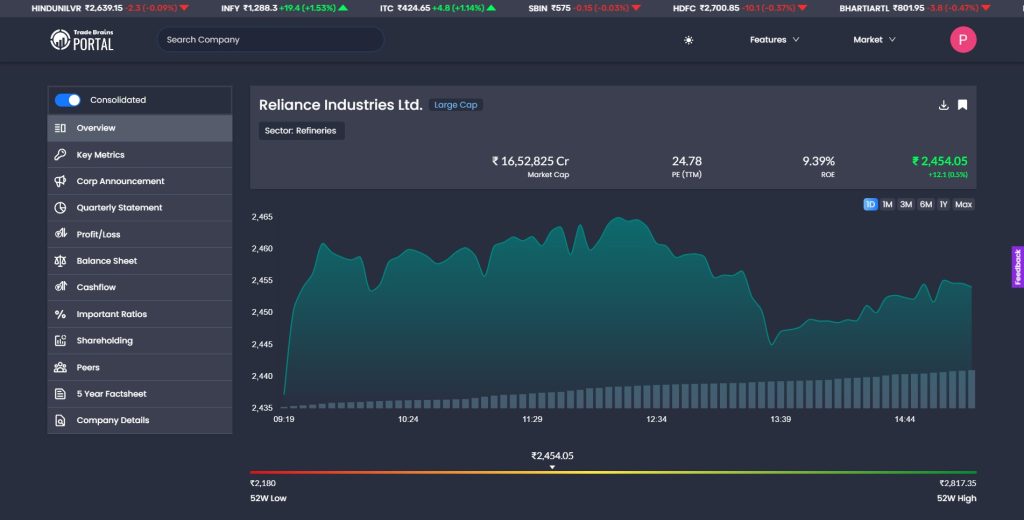

Further, you can also use our stock market analysis website “Trade Brains Portal“, to find these ratios. Let me show you how to find these key financial ratios on Trade Brains Portal. Let’s say, you want to look into all the above-mentioned financial ratios for “Reliance Industries”. Here’s what you need to do next.

Steps to Find Key Ratios on Trade Brains Portal

1) Go to Trade Brains Portal at https://portal.tradebrains.in/ and search for ‘Reliance Industries.

2) Select the company. This will take you to the “Reliance Industries” stock detail Page.

3) Scroll down to ‘5 Year Analysis & Factsheet’ and here you can find all the financial ratios for the last five years.

You can find all the key financial ratio analyses discussed in this article in this section of stock details. In addition, you can also look into other popular financial ratios like Profitability ratio, Efficiency ratio, Valuation ratio, Liquidity ratio, and more.

Conclusion

In this article, we discussed the list of Must Know Financial Ratio Analyses for stock market investors. Now, let us give you a quick summary of all the key financial ratios mentioned in the post.

8 Financial Ratio Analysis that Every Stock Investor Should Know:

- Earnings Per Share (EPS) – Increasing for the last 5 years

- Price to Earnings Ratio (P/E) – Low compared to companies in the same sector

- Price to Book Ratio (P/B) – Low compared to companies in the same sector

- Debt to Equity Ratio – Should be less than 1

- Return on Equity (ROE) – Should be greater than 20%

- Price to Sales Ratio (P/S) – Smaller ratio (less than 1) is preferred

- Current Ratio – Should be greater than 1

- Dividend Yield – Consistent/ Increasing yield preferred

In addition, here is a checklist (that you should download), which can help you to select a fundamentally strong company based on the financial ratios. Also, feel free to share this image with those whom you think can get benefit from the checklist.

That’s all for this post. Hope this article on ‘8 Financial Ratio Analysis that Every Stock Investor Should Know’ was useful for you. If you have any doubts or need any further clarification, feel free to comment below. We will be happy to help you. Take care and happy investing.

By utilizing the stock screener, stock heatmap, portfolio backtesting, and stock compare tool on the Trade Brains portal, investors gain access to comprehensive tools that enable them to identify the best stocks also get updated with stock market news, and make well-informed investment decisions.

Kritesh (Tweet here) is the Founder & CEO of Trade Brains & FinGrad. He is an NSE Certified Equity Fundamental Analyst with +7 Years of Experience in Share Market Investing. Kritesh frequently writes about Share Market Investing and IPOs and publishes his personal insights on the market.