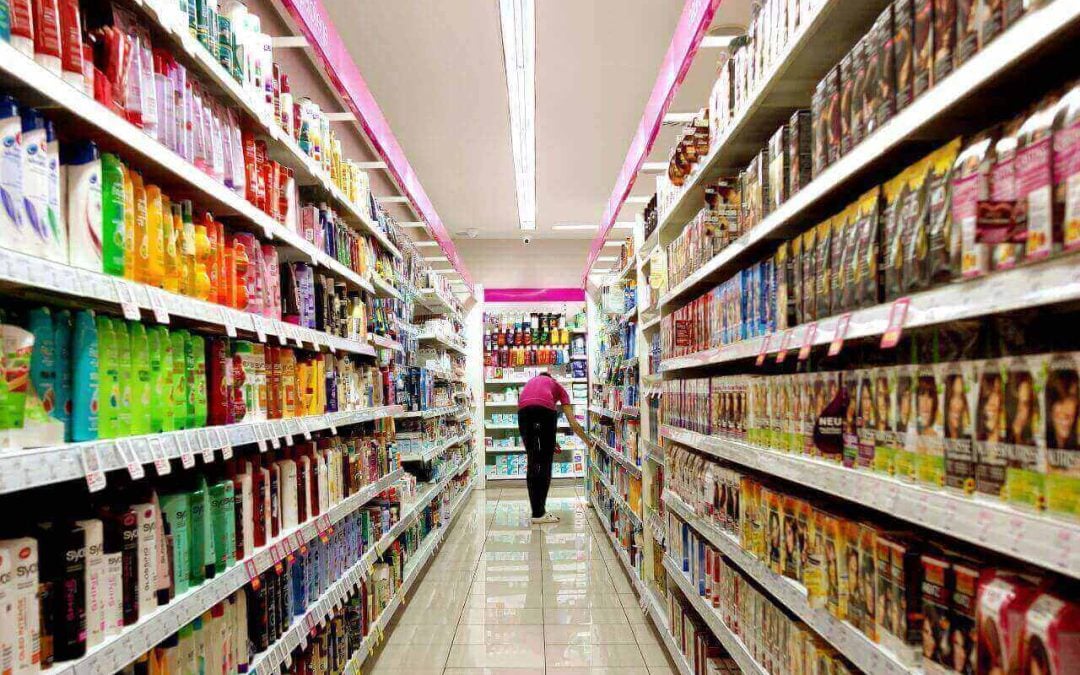

This Large-cap FMCG Stock, engaged in manufacturing and marketing a wide range of products, including foods, beverages, personal care, home care, and health & hygiene items, is in focus after Nuvama gave a target of Rs. 3,055, which has an upside potential of up to 34.29 percent.

With a market capitalization of Rs. 534,532.01 crore, the shares of Hindustan Unilever Limited is trading at Rs. 2,285.65 per equity share, up nearly 0.33 percent from its previous day’s close price of Rs. 2,278.05.

Nuvama, a prominent brokerage firm, has recommended a “Buy” call on Hindustan Unilever Limited with a target price of Rs. 3,055 per share, indicating an upside potential of 34.29 percent.

Nuvama has given a positive view on Hindustan Unilever Limited (HUL), citing its focus on direct-to-consumer (D2C) strategy, digital expansion, and affordability. HUL boosted its D2C play with the acquisition of Minimalist and raised digital spending to 40 percent. It launched products like Liquid I.V. and Hourglass from its parent portfolio while also improving access to affordable formats such as Rin liquid and BRU coffee.

Fabric wash and household care segments saw strong high single-digit volume growth, which is expected to continue. Although raw material costs like PFAD remained high, they may ease ahead. HUL expects 3-4 percent year-on-year volume growth in Q1FY26, up from 2 percent in Q4FY25. Nuvama noted a 200 bps portfolio shift to future-core and market-maker categories.

Hindustan Unilever Limited (HUL) was established in 1935 and is India’s largest fast-moving consumer goods (FMCG) company and a subsidiary of the global giant Unilever. HUL has been serving Indian consumers for over 90 years, reaching 9 out of 10 Indian households with at least one of its products every day.

Hindustan Unilever Limited manages over 50 brands across diverse segments, including foods, beverages, personal care, cleaning agents, and refreshment products, serving millions nationwide. In summer 2025, HUL launched Nexxus in India, marking its entry into the prestige and professional beauty segment.

Coming into financial highlights, Hindustan Unilever Limited’s revenue has increased from Rs. 15,210 crore in Q4 FY24 to Rs. 15,670 crore in Q4 FY25, which has grown by 3.02 percent. The net profit has decreased by 3.36 percent, from Rs. 2,561 crore in Q4 FY24 to Rs. 2,475 crore in Q4 FY25.

Hindustan Unilever Limited’s revenue and net profit have grown at a CAGR of 9.67 percent and 9.57 percent, respectively, over the last five years.

In terms of return ratios, the company’s ROCE and ROE stand at 27.8 percent and 20.7 percent, respectively. Hindustan Unilever Limited has an earnings per share (EPS) of Rs. 45.3, and its debt-to-equity ratio is 0.03x.

Written By – Nikhil Naik

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.