The shares of an Indian FMCG company are in focus after the company announces robust results. With Revenue growth of 18 percent Y-O-Y, the Net profits are up by 74 percent.

The shares of Patanjali Foods Ltd with a market capitalization of Rs. 64,199.59 crores on Friday. Its shares are trading at a CMP of Rs 1,772.60, against the previous closing price of Rs 1,811.10. The stock has given a good return of 27.15 percent in the past year.

What Happened

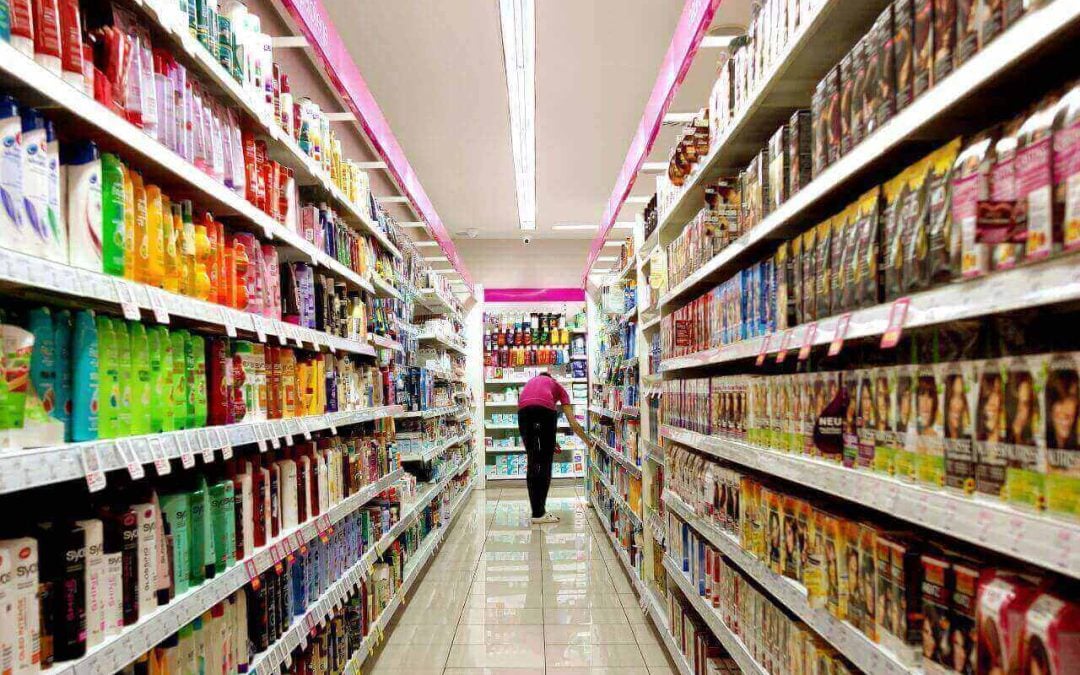

Patanjali Foods Ltd, a company that is involved in Fast-Moving Consumer Goods (FMCG) and Fast-Moving Health Goods (FMHG) business, announced its results for the Financial year ‘25. Its Revenue grew by 18 percent YoY from Rs 8,228 Crores in Q4FY24 to Rs 9,692 Crores in Q4FY25, and it has increased by close to 6.2 percent QoQ from Rs 9,120 Crores in Q3FY25 to Rs 9,692 Crores in Q4FY25.

Its Net Profit grew by 74 percent YoY from Rs. 206 Crores in Q4FY24 to Rs. 359 Crores in Q4FY25. But the Net profits have decreased by 3.23 percent QoQ from Rs. 371 Crores in Q3FY25 to Rs. 359 Crores in Q4FY25.

The company’s Earnings Before Interest, Depreciation, and Taxes (EBIDT) has also grown by 37 percent YOY from Rs 377 crores in Q4FY24 to Rs 516 crores in Q4FY25. Its EPS has also grown by 74 percent YOY from Rs. 5.70 in Q4FY24 to Rs. 9.90 in Q4FY25.

Key performance Highlights

Patanjali Foods delivered a solid performance in FY25, particularly in its Edible Oils segment, which crossed the Rs 1,000 crore EBITDA mark, showcasing strong profitability. The Food & FMCG segment, including the HPC business, contributed 30.61 percent to the revenue in Q4FY25, with rural demand notably surpassing urban consumption.

The company achieved export revenues of Rs 73.44 crore in Q4FY25, expanding its presence across 29 countries. Despite a moderate operating environment and margin pressures from elevated raw material costs and higher ad spends, the company’s consumer staples segment generated Rs 1,034.65 crore in revenue, with TSP sales contributing Rs.102.83 crore.

Biscuits & Confectionery reported Rs 426.25 crore in Q4 revenue and Rs 1,677.38 crore for the full year. Notably, Doodh biscuits crossed the Rs 1,000 crore annual revenue mark, and Nariyal biscuits continued to post strong growth.

About the company

Ruchi Soya Industries Ltd is a prominent Indian company specializing in edible oils, soya foods, and related products. Established in 1986, it has grown into one of India’s largest integrated edible oil and soya processing firms, with a significant presence across the entire value chain—from oilseed crushing to refining, packaging, and distribution

In 2019, Ruchi Soya underwent a major transformation when it was acquired by Patanjali Ayurved through an insolvency resolution process for ₹4,350 crore. This acquisition integrated Ruchi Soya into the Patanjali Group, enabling synergies in sourcing, manufacturing, and distribution. In June 2022, the company rebranded as Patanjali Foods Ltd to align with its parent company’s brand identity.

Written By Likesh Babu S

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Dailyraven Technologies or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.