Synopsis- Gold prices in India have hit a new lifetime high with 24-carat gold approaching ₹1,17,500 per 10 grams driven by a combined influence of domestic and global economic factors.

Gold has always been a reliable investment worldwide, especially in India, where cultural and financial factors keep demand strong. As of September 2025, gold prices in India have hit record highs, with 24-carat gold near ₹117,500 per 10 grams. This surge is driven by strong local buying and global economic trends, creating momentum that looks set to continue in the near future.

Factors Driving the Gold Price Rally

- One big factor behind the recent jump in gold prices is all the talk about the US Federal Reserve easing up on its tight monetary policy. They’re likely to cut interest rates pretty soon. That should weaken the dollar a touch. A softer dollar makes gold look like a steal for buyers overseas. It draws in more demand from everywhere. Thus, increasing prices.

- In India, this lines up perfectly with the festive season kicking into high gear. People grab gold like it’s the last chance they’ll get.The seasonal buying spree pushes prices up even more. It doesn’t end there.

- The nation’s import patterns and the Reserve Bank of India’s push to stockpile reserves add extra fuel to the fire.

- Central banks around the world have ramped up their gold stashes too. Especially after geopolitical flare-ups like the Russia-Ukraine mess.

Investment and Demand Patterns

People still flock to gold when the economy starts looking shaky. It’s that reliable fallback, like an old friend you trust in tough times. Truth is, with all the buzz about a global slowdown and geopolitical headaches, investors keep seeking refuge in gold and put their money into gold ETFs and futures. That steady demand just won’t quit. India’s local buying habits back up this upbeat view pretty solidly. Government policy like the GST changes is boosting gold sales quite a bit. They’re also clearing up the market, making it more straightforward and smoother.

Also read: Top 5 Indian States That Recorded the Highest Digital Transactions in August 2025

Potential Challenges and Price Corrections

- Even with those upbeat signs, we should still tread carefully. Gold prices climbing higher might squeeze affordability for India’s middle-class folks. That could easily cool off demand if they shoot up too much from here.

- Here’s the thing with surging gold imports into India. They could throw off the current account balance in a bad way. That might bring in more regulatory eyes or tweaks to import duties. And yeah, those changes could shake up prices a bit.

- Short-term corrections might pop up now and then. But experts say they’ll stay pretty contained. Strong demand underneath and solid economic vibes should keep things in check. Forecasts point to stabilisation around ₹114,500 to ₹115,300 per 10 grams on MCX futures. Globally, prices hover near $3,820 to $3,850 per ounce. Overall, it’s still heading up.

Next 5 years

- Things pushing gold prices up include inflation, shaky geopolitics, what central banks are up to, and even new tech making mining smoother.

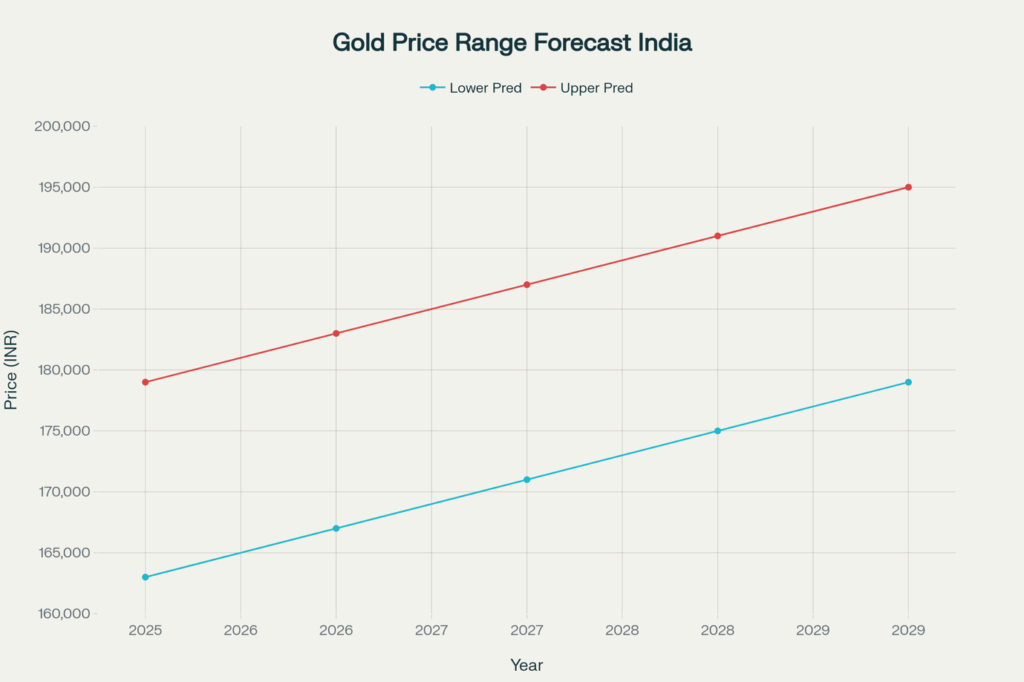

- Prices should creep higher year by year. By 2029, they might hit anywhere from Rs. 1,63,000 to Rs. 1,95,000 per ounce.

- If you are planning on investing in gold here is a prediction to help you reach a decision.

| Year | Predicted price range (per ounce) |

| 2025 | ₹1,63,000 – ₹1,79,000 |

| 2026 | ₹1,67,000 – ₹1,83,000 |

| 2027 | ₹1,71,000 – ₹ 1,87,000 |

| 2028 | ₹1,75,000 – ₹ 1,91,000 |

| 2029 | ₹1,79,000 – ₹1,95,000 |

**The predictions given above are based on current factors like the economy, policies and other factors.**

Conclusion

Gold prices in India look pretty good for the near term. Things like changes in monetary policy, that steady cultural demand we all know about, ongoing geopolitical tensions, and some solid investment trends are backing it up. Sure, there might be a few small dips along the way. Still, with strong buying from folks at home and big global institutions jumping in, prices should keep heading up. In these uncertain times, gold really stands out as a smart investment choice.

Written by Jayanth R Pai