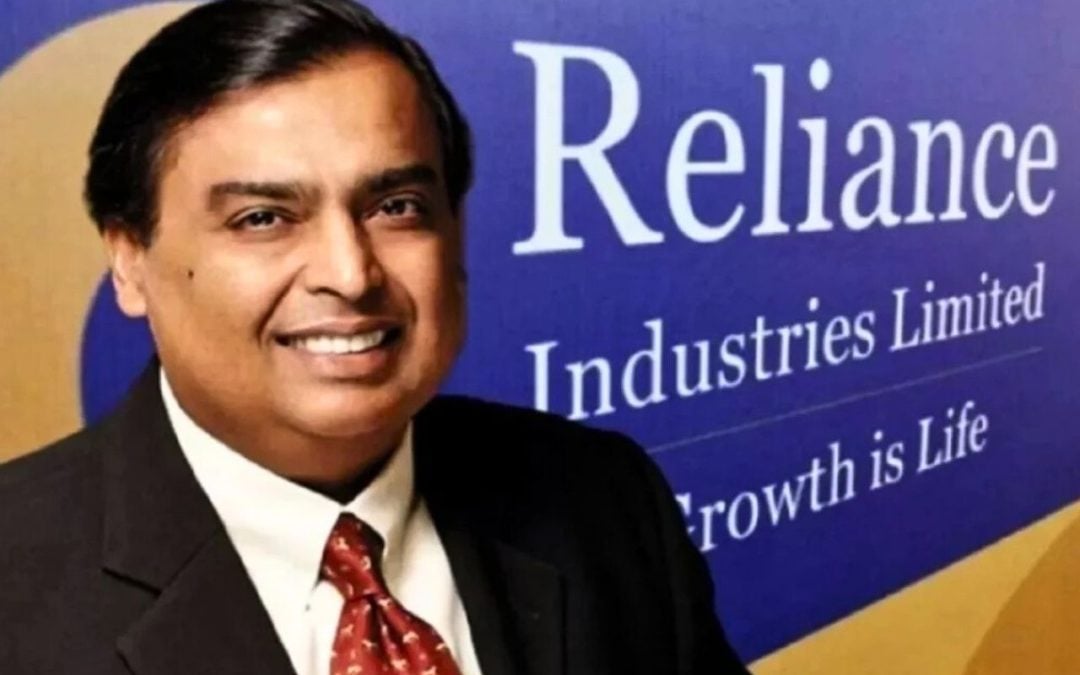

The shares of the prominent infrastructure company gained up to 6 percent in today’s trading session after the company bagged a significant Letter of Award from Reliance Industries Limited worth Rs 700 crore.

With a market capitalization of Rs 16,349.87 crore, the shares of Afcons Infrastructure Ltd were trading at Rs 444.25 per share, increasing around 2.11 percent as compared to the previous closing price of Rs 435.05 apiece.

The shares of Afcons Infrastructure Ltd have seen positive movement after bagging a significant Letter of Award from Reliance Industries Limited worth Rs 700 crore for RIL’s Vinyl Projects at Dahej, Gujarat, which involve construction, including civil, mechanical, installation, testing, and commissioning works as part of the project’s comprehensive development scope.

Looking forward to the company’s financial performance, revenue decreased by 11 percent from Rs 3,636 crore in Q4FY24 to Rs 3,223 crore in Q4FY25. Further, during the same time frame, net profit declined by 23 percent from Rs 145 crore to Rs 111 crore.

Also read: Will Zomato Be Able to Cross the ₹300 Mark? Here Are the Reasons

Afcons’ order book shows steady growth over three fiscal years, rising from Rs 30,406 crore in FY23 to Rs 30,961 crore in FY24, and further increasing to Rs 36,869 crore in FY25, reflecting robust project acquisition.

Afcons targets 20–25% revenue growth in FY26, with Rs 20,000–25,000 crore in new orders, excluding Rs 10,500 crore in L1 orders. Long-term revenue CAGR is guided at 15%. EBITDA margin is expected to remain around 11%, driven by strategic project selection and risk control. The company aims to maintain 30% of its revenue from international operations through cautious expansion and new JVs.

Afcons’ FY25 capex was Rs 370 crore against a planned Rs 1,300 crore due to delays in TBM procurement and project awards. FY26 capex is set at Rs 1,100 crore. FY25 depreciation stood at Rs 491 crore, with one-third from TBMs; FY26 depreciation is expected to increase by 10–12 percent year-on-year.

Afcons Infrastructure operates across five key infrastructure sectors. The marine and industrial segment handles projects related to ports and harbour jetties, dry docks, wet basins, breakwaters, outfall and intake structures, liquefied natural gas tanks, and material handling systems.

Written by Abhishek Singh

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.