The Relative Strength Index (RSI) is a popular technical indicator used by traders to analyze the momentum of price movements in financial markets. It measures both the speed and magnitude of recent price changes on a scale of 0 to 100, helping investors identify potential trend reversals and evaluate the strength of ongoing trends.

When the RSI moves above 70, it often signals that a stock or asset is overbought, implying prices may have risen too quickly and a correction could follow. On the other hand, an RSI below 30 suggests oversold conditions, indicating the asset might be undervalued and could soon see a price recovery or upward reversal.

Here are the list of stocks trading below RSI 30;

Maharashtra Scooters Ltd

Maharashtra Scooters Ltd, a joint venture between Bajaj Auto and Western Maharashtra Development Corporation, is engaged in investments and holds significant stakes in Bajaj Group companies. It focuses on generating steady returns through strategic holdings, making it a stable and financially strong investment company in India.

With a market capitalization of Rs. 16,800 crores on Tuesday, the stock closed at Rs. 14,700 apiece, with an RSI of 20.74, indicating that it is in the oversold zone, offering the potential for an upside bounce.

Transformers and Rectifiers (India) Ltd

Transformers and Rectifiers (India) Ltd is one of India’s leading power equipment manufacturers, specializing in transformers for power, industrial, and renewable sectors. Known for its strong R&D and quality engineering, the company plays a key role in supporting India’s transmission and distribution infrastructure growth.

With a market capitalization of Rs. 12,578 crores on Tuesday, the stock closed at Rs. 419 apiece, with an RSI of 18.01, indicating that it is in the oversold zone, offering the potential for an upside bounce.

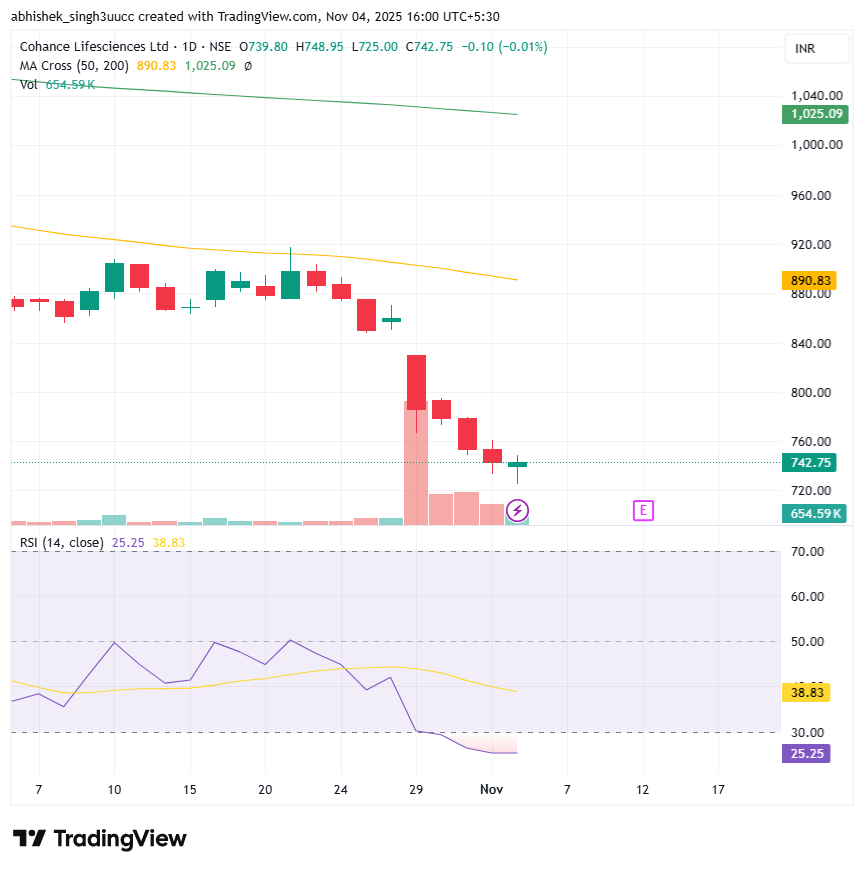

Cohance Lifesciences

Cohance Lifesciences is a fast-growing specialty chemicals and life sciences company offering advanced intermediates, contract development, and manufacturing solutions. Focused on sustainability and innovation, it serves global pharmaceutical and agrochemical industries, strengthening India’s position in high-value chemistry and integrated supply chain solutions.

With a market capitalization of Rs. 28,459 crores on Tuesday, the stock closed at Rs 744 apiece, with an RSI of 25.25, indicating that it is in the oversold zone, offering the potential for an upside bounce.

Jindal Saw Ltd

Jindal Saw Ltd is a leading manufacturer of large-diameter steel pipes used in oil, gas, and water transportation. Backed by strong infrastructure and global operations, the company contributes significantly to India’s industrial and energy sectors, focusing on quality engineering and sustainable manufacturing practices.

With a market capitalization of Rs. 10,929 crores on Tuesday, the stock closed at Rs. 171 apiece, with an RSI of 24.07, indicating that it is in the oversold zone, offering the potential for an upside bounce.

Gillette India Ltd

Gillette India Ltd, part of Procter & Gamble, is a premier personal care company known for iconic brands like Gillette and Oral-B. It leads India’s grooming and shaving segment through innovation, strong brand equity, and continuous focus on product quality and consumer trust.

With a market capitalization of Rs. 28,467 crores on Tuesday, the stock closed at Rs. 8,735 apiece, with an RSI of 24.32, indicating that it is in the oversold zone, offering the potential for an upside bounce.

Written by Abhishek Singh

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.