A Guide on NSE Indexes that you should know: An Index is basically the stock exchange creating a portfolio of the top securities held by it. Indexes have always played an important role for both investors and companies by offering a reliable benchmark. They have also been used as an investment strategy where Investment Managers just set up their fund portfolios to simply track the index in an attempt to gain similar market returns. Indexes play an important role as they also stand in representation of a country’s market and economy.

Today, we discuss the various indexes offered by the National Stock Exchange (NSE) and the role they play for different stakeholders with an attempt to help you get a better insight into indexes. Here, we’ll look into popular NSE indexes and sectorial indexes like Nifty50, Nifty100, Nifty largecap, Nifty midcap, Nifty smallcap etc. Let’s get started.

Indexes offered by the NSE

— Broad Market Indexes

Broad Market Indexes are used to give an indicator of the movement of the economy. They are considered suitable for this as they include stocks from all industries. The indexes are designed to reflect the movement of a group of stocks considered in that portfolio or the market as a whole. The broad market index considers the stock from various sectors. Broad market indexes consider only the top stocks in the market. Hence it can be safe to say that the broad market indexes are the buffet among indexes.

Assessing the broad market index from their names

The broad market indexes generally have the Index_name pertaining to the stock market followed by the number of stocks of different companies it considers. This allows a stakeholder to assess accordingly the degree of diversification and exposure available in that index.

Broad market indexes from NSE India

- Nifty 50

- Nifty 100

- Nifty 150

- Nifty 200

- Nifty 500

Here the number next to the index name ‘Nifty’ represents the number of stocks the index considers. The greater the number of shares the more diversified the portfolio will be. But the greater the number of stocks also represents the greater exposure to risk. Indexes like Nifty 500 will have the top 500 stocks available in the NSE universe. This index will have a considerable number performing well but also a great number of stocks performing negatively. The Nifty 200 will contains the top 200 stocks from Nifty 500. The Nifty 150 will contain the top 150 stocks from Nifty 200 and so on. The Nifty 50 consists of the top 50 stocks in the NSE.

Nifty 50 is considered to be a representation of the Indian markets over other broad market indexes by NSE. This is because it represents the best-case scenario in both bullish and bearish times represented by the best companies. All companies considered in these broad market indexes are large-cap.

— Broad market indices based on capitalization.

The broad market indexes are made available based on the extent of capitalization. Market capitalization is the total value of the companies stock. Market cap is calculated by multiplying the share price of a stock with the total number of public shares offered by the company. This ensures that both the size and prize are given consideration. Based on this computation the stock market is divided into large-cap, mid-cap, and small-cap.

How are large-cap, small-cap, and mid-cap classified?

- Large-cap refers to a company with a market cap of more than 28,000 crores.

- Mid-cap refers to a company with a market cap valuation of more than 8,500 crores and less than 28,000 crores.

- Small-cap refers to companies with a market cap valuation of fewer than 8,500 crores.

Assessing broad market indexes from their names

Here the indexes have the Index_name followed by the cap. size further followed by the number of shares held in the index portfolio. Eg. Nifty Midcap 50 — This shows that the index holds 50 different stocks of companies from the Mid-cap category.

Broad Market Indexes based on cap size offered by NSE India?

The broad market indexes offered based on capitalization are

-

Nifty Smallcap (50, 100, 250)

The companies included in this index portfolio are those with relatively small market capitalization. This index is important because they include stocks that are not considered in other broad market caps like Nifty ( 50, 100, 150, 200). This is because indexes like Nifty 50 include stocks from the top-performing industries which are from the large-cap category. The Nifty small-cap includes securities from which investors can earn higher amounts of returns due to the possibility of the range of growth available to small-cap companies. However, these higher returns come with higher risk from higher volatility to investors. The risk is increased considering that the information available on these companies is low.

-

Nifty Mid-cap (50,100,150)

The shares of the companies included here are those whose market cap falls in between large and small-cap. Mid-cap includes shares that offer better growth potential than large-cap funds and lesser risk than those from small-cap securities. The stocks included here are for investors with moderate risk appetite. The Nifty Midcap indexes can be used by companies that have a market cap of more than 5000 crores but less than 20,000 crores to assess their performance growth rate and returns offered to their investors. The same can be done by investors.

-

Nifty MedSml 400

The Nifty Mid Small 400 Index includes shares of 400 companies from both the Medium and Small-cap. The Nifty Midsml 400 is a combination of the Nifty Midcap 150 and Nifty Smallcap 250 index. Hence it includes 150 companies with medium-cap and 250 companies with small-cap. It is appropriate for funds to attract and offer investors a higher growth rate and returns from the small-cap companies and some degree of increased security from mid-cap companies.

-

Nifty Large Midcap 250

The Nifty Large Midcap includes a portfolio of 100 large-cap and 150 mid-cap companies. It is a combination of the Nifty 100 and the Nifty Midcap 150 index. This index can be followed by funds that want to offer the least risk but low returns available from large-cap to balance off the high risk and high returns of midcap.

— Other Broad Market Indices

-

The Nifty Next 50

The Nifty Next 50 includes shares of stock that are from Nifty 100 but do not make it into the Nifty 50 Index. Therefore it is the Nifty 100 index excluding the Nifty 50.

-

Nifty VIX

The Nifty VIX stands for the Nifty volatility index. Generally, indexes only include shares of companies but this index includes derivative products. This index is based on the Nifty index option prices.

Also read: What is India VIX? Meaning, Range, Implications & More!

How have broad market indexes performed in the last 5 years?

| Index | As of 01/04/2020 | As of 24/01/2020 | % change | As of 29/05/2020 | % change since 01/2020 |

|---|---|---|---|---|---|

| Nifty 50 | 7713.05 | 12248.25 | 58% | 9580.3 | -21.78% |

| Nifty 100 | 8404.15 | 12386.95 | 47.39% | 9648.2 | -22.11% |

| Nifty SmlCap 50 | 2696.59 | 3086.05 | 14.44% | 1879.45 | -39.10% |

| Nifty SmlCap 250 | 4051.1 | 5280 | 30.33% | 3538.75 | -32.98% |

| Nifty MidCap 150 | 4209.39 | 6742.45 | 60.18% | 5053.7 | -25.05% |

| Nifty MidSml 400 | 4151.76 | 6219.8 | 49.81% | 4507.5 | -27.50% |

(Historical NSE Indexes Performance – Source Bloombergquint)

— Sectoral Indexes offered by NSE

Sectoral indexes summarise top performing stocks from the respective industry together and provide a summary of how the specific sector is performing. This acts as a benchmark for its users to either compare company performance with the respective sector index or compare the sector’s performance to the market. This is done by comparing the sectoral indexes with the broad market indexes.

Sectoral Indexes Offered by the NSE

Sectoral Index Sector Types of companies included Number of companies Considered to portfolio

Nifty RealtyÊ Real EstateÊ Real Estate Companies 10

Nifty BankÊ Banking Large Indian Banks 12

Nifty Auto Automobile All vehicle Manufacturing, tires, and other auto auxiliaries 15

Nifty Financial Services FinancialÊ Banks, Financial Institutions, Housing Finance, and Other Financial Services 15

Nifty FMCG Index FMCG Companies that produce durable and mass consumption productsÊ 15

Nifty IT Index IT sector Companies included are those that have over 50% of their income from IT-related activities like IT infrastructure, IT education and software training, Telecommunication services and Networking Infrastructure, Software development, hardware manufacturing, and Support and Maintenance. 10

Nifty Media Media and Entertainment Stocks from printing and publishing are also included apart from Media and Entertainment. 13

Nifty Metal MetalÊ and Mining Sector Companies from both the metal and mining sectors. 15

Nifty Pharma Healthcare Healthcare and Pharma companies 15

Nifty Pvt Bank Index Banking Top Private Banks 10

Nifty Pub Bank Index Banking Top PSU Banks 13

(Historical NSE Sectorial Indexes Performance – Source Bloombergquint)

— Strategy Indices

Strategy indices involve adopting one of the following strategies to create a portfolio. They give investors the possible top stocks that suit the respective factors. The major strategy indices are

Nifty Alpa 50

Alpha is generally the difference between the returns from an investment or portfolio in comparison to the overall market. The condition for an alpha stock to be considered into the index portfolio is that it should have a pricing history of at least a year.

Nifty 100 Quality 30

A stock qualifies as quality stock if it has

- A high Return on Equity (ROE = Net Income/ Shareholders Equity)

- Low Debt-Equity Ratio

- An average change in Profit After Tax(PAT)

The condition for the quality stock to be considered into the index portfolio is that it should have a positive PAT in the previous year.

Nifty 50 Value 20

A stock qualifies as value stock if it has

- High ROCE ( Operating Profit/Capital Employed)

- High Dividend Yield

- Low Price to Earnings Ratio

- Low Price to Book Ratio

The condition for the value stock to be considered into the index portfolio is that it should have a positive PAT in the previous year.

Nifty 100 LowVol 30

A stock qualifies as low volatility stock if it has a low standard deviation of price returns. The condition for the low volatility stock to be considered into the index portfolio is that it should have a pricing history of at least a year.

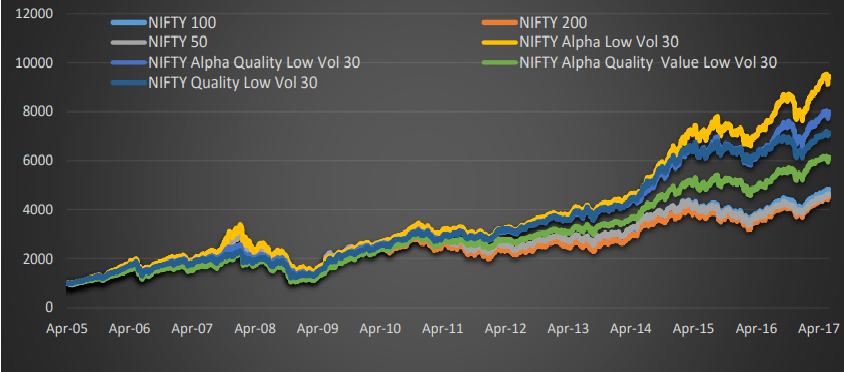

— Multi-Factor Indices

The quest to beat the returns offered by the broad market index has given rise to multi-factor indices. In investing when the fund manager follows the portfolio of an index it is known as Passive Investing. When the fund manager devises his own strategy to create a portfolio with the aim of beating the benchmark it is known as active investing.

Multi-Factor indices use the rule-based approach of following an index from passive investing and the strategy of relying on multiple factors to select stock from active investing. The factors majorly used by strategy indices are – Alpha, Quality, Value, and Low Volatility. A strategy index creates a portfolio of 30 stocks based on 2 or more of these factors.

Some of the Multi-Factor Indices are-

- NIFTY Alpha Low-Volatility 30

- NIFTY Quality Low-Volatility 30

- NIFTY Alpha Quality Low-Volatility 30

- NIFTY Alpha Quality Value Low-Volatility 30

Performance of multi factor indices in comparison to other indices

Closing Thoughts

The indexes discussed here form a very small portion of the indexes offered by the NSE. As of data in 2016, there were 67 Indexes offered by the NSE. Just like popcorn, which is not a necessity in any staple diet, it still has a role to play during recreation. Similarly, there are various indexes offered which may not represent the market but still have an important role to play.

Aron, Bachelors in Commerce from Mangalore University, entered the world of Equity research to explore his interests in financial markets. Outside of work, you can catch him binging on a show, supporting RCB, and dreaming of visiting Kasol soon. He also believes that eating kid’s ice-cream is the best way to teach them taxes.