A Brief Study on Public vs Private Banks in India: Regardless of which sector one works in, it relies on the banking sector. This is the very reason why the banking sector is known as the backbone of the economy. A country with a poor banking sector is not only destructive to the banking industry but also to economic growth overall.

Due to its importance today we try and understand the banking sector through its division of public and private banks and analyze their contributions to helping the economy grow or not in the recent past

What do you mean by Public and Private banks?

Banks are classified as Public or Private depending on their ownership. First, let us understand the basic difference between Public vs Private Banks in India:

— Public Sector Banks

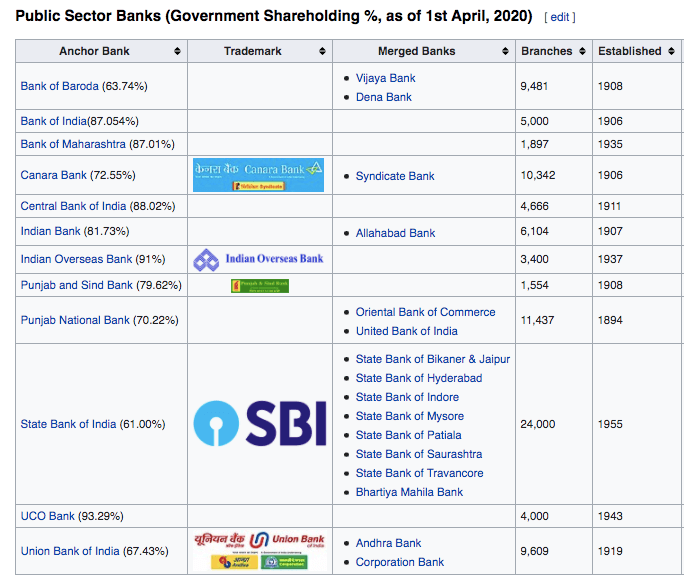

A Public sector bank is one where the government owns a majority stake (i.e. more than 50%). In common parlance, they are also known as government banks. Due to its ownership, the aims set for these banks revolve around social welfare and fulfillment of the country’s economic needs. These banks are formed by passing Acts in the parliament. Eg. Bank of India, Canara Bank, Punjab National Bank, Bank Of Baroda, State Bank of India.

(Source: Wikipedia)

— Private Sector Banks

A Private sector bank is one where the majority stake is held by private organizations and individuals. Private banks have profit maximization set as their main goals. These banks are registered under the Companies Act.

Eg. HDFC Bank, ICICI Bank, Kotak Mahindra Bank, Axis Bank, Yes Bank.

Differences in the working of Public vs Private Banks in India

Although the banks being public or private perform the same functions, due to their aims and period of existence customers notice significant differences depending on the banks they choose.

Private banks arrived relatively late in the Indian banking sector thanks to the reforms introduced in 1991. This is one of the reasons why people find public banks secure as they already have been around longer enabling them the gain their trust. Also, the confidence that the government will not let a public bank fail adds to this security. Private banks make up for these security concerns through their technological advancements and superior customer service.

What is it like to work for these two bank types?

In the year 2013 80,000 government bank jobs received close to 40 lakh applications making it one of the most sought after careers. The reason for this has been the job security and reduced work pressure present in these banks. This, unfortunately, has reflected on the banking sector as public banks have been known to take too long to perform duties.

This can be attributed mainly to the fact that the employees do not have any incentives to work better. The competitiveness faced here is prior to the job in the examination set during the selection process.

Working for private banks, on the other hand, increases the rewards available to an individual but with additional risk. Employees receive higher remunerations but are required to work in highly competitive environments. This too has rubbed off on how the functioning of private banks is viewed i.e. fast-paced, efficient, and easier to deal with.

Which one is performing better?

— Customer Base

( ATM with the highest altitude in India, present in Sikkim)

Longer periods of existence in the Indian markets have allowed public banks to develop a larger customer base in comparison to the private banks. The goals set have also played a major role in achieving this. Public banks function with the aims of ensuring banking accessibility throughout the country.

This has motivated the public banks to penetrate deeper into rural areas gaining a greater customer base. Private banks, on the other hand, enter only areas where they see a potential to earn a profit. This is the reason private banks mainly function in urban areas and not rural.

— Market Share

As of 2018 public sector banks account for 62% of the total banking assets and 58% of the total income, the rest occupied by private banks. Although public banks have a greater market share, their hold has been continuously slipping. As of 2016 public sector banks accounted for 75% of the total banking assets and 71% of the total income.

Public banks are steadily losing out even when it comes to loans. Figures from 2018-19 show that private banks gave a total of ₹7.3 trillion in loans, while public sector banks gave ₹2.3 trillion in loans. In comparison the total amount of loans in 2011 which stood at ₹40.8 trillion, public sector banks had a share of 74.9% and private sector banks around 17.8%.

The one segment that we would expect public sector banks to not loose out one is deposits. Especially after considering the security of deposits it to be one of their USP’s. But unfortunately over the last few years, public sector banks have lost market share here too. As of 2011 the total amount of deposits in the Indian banking system stood at ₹53.9 trillion, public sector banks had a share of 74.6% in it. The share of private sector banks was a little over 18%. By 2019 the total amount of deposits in the Indian banking system stood at ₹125.6 trillion. Of these Public sector banks had 63.1% of these deposits and private sector banks 28.7%.

— Non-Performing Assets (NPA)

One would expect private banks to have a high number of NPA’s considering that in order to gain an edge over public banks the private banks may be more approachable when it comes to loans, leading to higher NPA’s. But this has not been the case as the NPA’s of private sector banks have been lower in comparison to private banks.

In the 5 years leading up to 2018, the NPA’s of private sector banks increased from 0.7% in 2014 to 2.4% in 2018. Figures that seems reasonable in comparison to that of the private sector where the NPA’s rose from 2.6% in 2014 to 8.00% in 2018 and have been increasing since then.

Closing Thoughts

It is evident that although the public sector still holds a greater market share they have not been able to compete with the growth rate of private banks. In order to achieve this, Private banks have capitalized on the weaknesses of Public Banks. Coupling superior customer service with the inclusion of technological changes has worked out in favor of the private banks. It is good to see that these measures adopted by private banks are forcing the public banks to implement them too.

But if the public banks keep playing catch up with the private banks they will soon be seen falling behind even in terms of market share. This has called for multiple structural reforms to ensure that does not happen because at the end of the day it is the public banks that look after and perform in the interest of the economy.

Aron, Bachelors in Commerce from Mangalore University, entered the world of Equity research to explore his interests in financial markets. Outside of work, you can catch him binging on a show, supporting RCB, and dreaming of visiting Kasol soon. He also believes that eating kid’s ice-cream is the best way to teach them taxes.