India’s refining capacity reached 256.8 MMTPA by April 2024, up from 215.1 MMTPA in 2014, with petroleum product GVA rising to Rs 2.12 lakh crore (2022-23). The sector, employing millions, processes 5.3 million b/d crude (Nov 2024), while oil demand is projected to grow at 3.2 percent in 2025, driven by industrial expansion and mobility needs, with refining capacity expected to expand 20 percent by 2028.

Price Movement

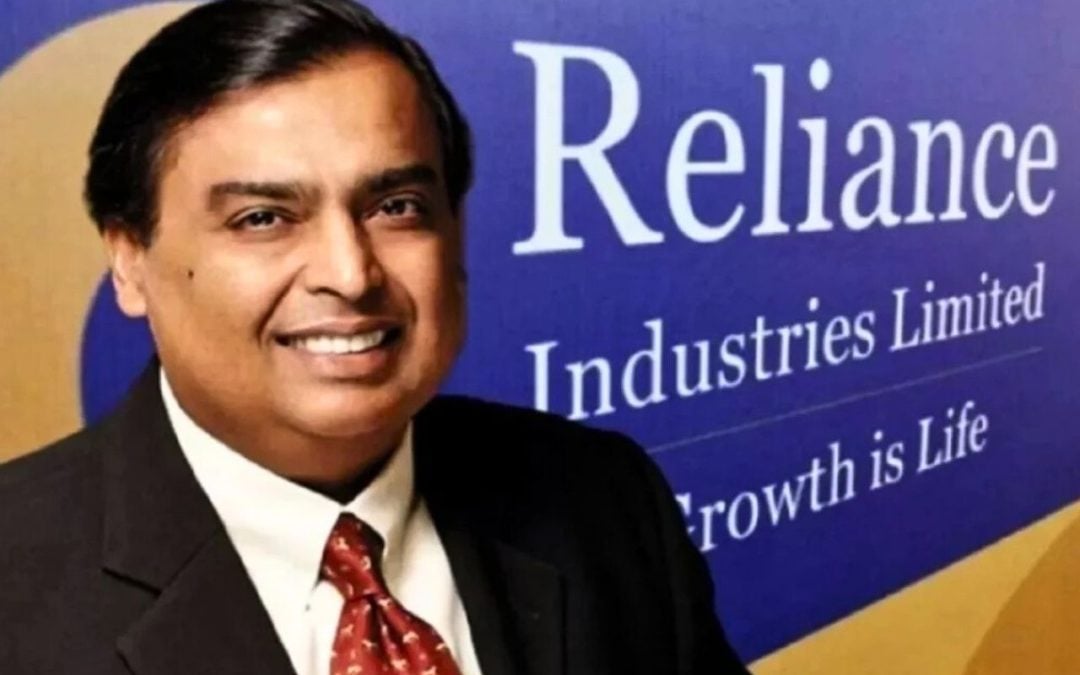

With a market capitalization of Rs 19.05 lakh crore, the shares of Reliance Industries Ltd closed at Rs 1,408.35 per share, increasing around 0.57 percent as compared to the previous closing price.

Revenue Segmentation

For the quarter ended March 31, 2025, total revenue stood at Rs 3,20,471 crore. Segment-wise, Oil to Chemicals contributed 51.36% ( Rs 1,64,613) crore, Retail 28% (Rs 88,637 crore), Digital Services 13% ( Rs 40,861 crore), Oil and Gas 2% (Rs 6,440 crore), and Others 6.2% (Rs 19,920 crore), highlighting strong performance from the core and consumer-facing businesses.

Financial Growth

Looking forward to the company’s financial performance, revenue magnified by 10 percent from Rs 236,533 crore in Q4FY24 to Rs 261,388 crore in Q4FY25, Further, during the same time frame, net profit zoomed by 7 percent from Rs 21,243 crore to Rs 22,611 crore.

Also read: 5 Smallcap Wastewater Management Stocks Under ₹500 to Watch in 2025

Capacity expansion

Reliance Industries Ltd is expanding polyester capacity by 1 million tonnes and integrating it with a 3 million tonne PTA facility, targeting premium segments by 2027–28 under its Rs 75,000 crore O2C capex plan. A Rs 60–65,000 crore PVC project addresses India’s deficit, with commissioning by 2026–27 and benefits from chlorine integration.

Brokerage Target

Recently, Goldman Sachs, one of the well-known brokerages globally, gave a ‘Buy’ call on the Refineries stock with a target price of Rs 1,640 apiece, indicating a potential upside of 16 percent from Wednesday’s closing price of Rs 1,408.35 per share.

Company profile

Reliance Industries Limited is an India-based company that is engaged in the activities of hydrocarbon exploration and production, petroleum refining and marketing, petrochemicals, advanced materials and composites, renewables (solar and hydrogen), retail and digital Services.

Written by Abhishek Singh

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Dailyraven Technologies or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.