Synopsis:

Syrma SGS secures Rs. 856 crore Andhra incentives to build India’s largest PCB plant at Naidupeta with Shinhyup Electronics; Rs. 1,595 crore investment plans to start by 2026, boosting FY27 revenue to Rs. 6,200 crore.

During Thursday’s trading session, shares of a leading Indian electronics systems design and manufacturing company jumped nearly 6 percent to hit a record high at Rs. 837.5 on BSE, following reports of Andhra Pradesh’s Rs. 856-crores incentive approval to set up India’s largest printed circuit board (PCB) plant.

At 02:39 p.m., the shares of Syrma SGS Technology Limited were trading in the green at Rs. 835.3 on BSE, up by around 5.5 percent, as against its previous closing price of Rs. 791.8, with a market cap of Rs. 16,076 crores. The stock has delivered positive returns of over 91 percent in the last one year, and has gained by around 15 percent in the last one month.

What’s the News

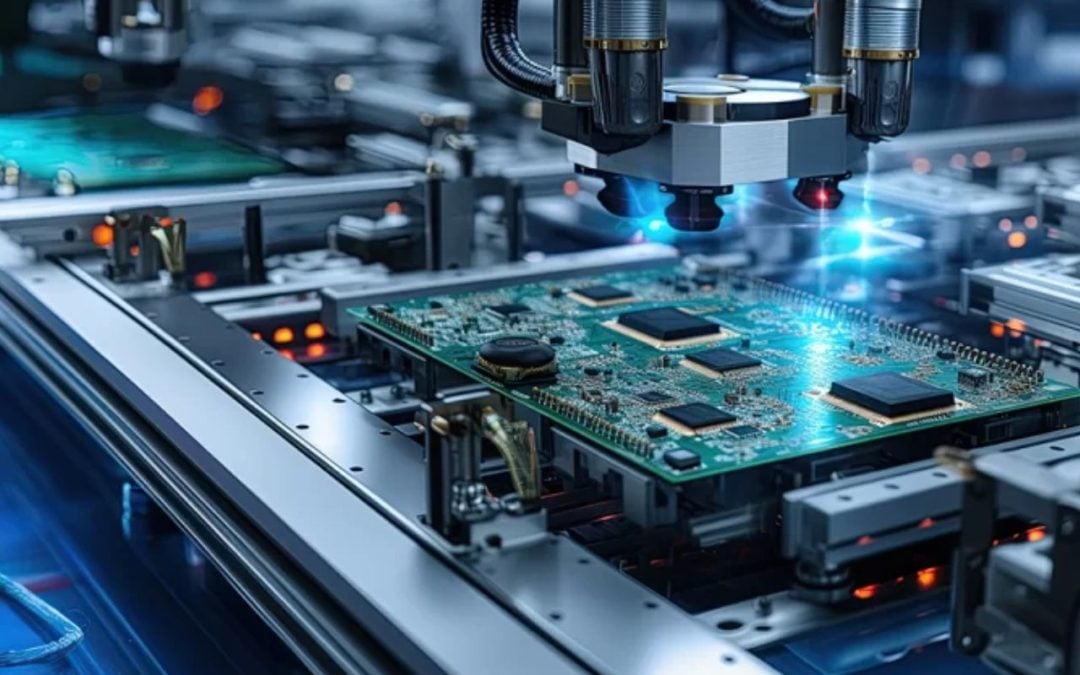

As per reports, Syrma SGS Technology Limited has secured approval from the Andhra Pradesh government for an incentive package worth Rs. 856 crore to set up a large-scale printed circuit board (PCB) facility.

On 4th September, Chief Minister N. Chandrababu Naidu’s cabinet cleared the company’s proposal to establish what is expected to be India’s biggest PCB manufacturing plant. According to sources, the state will allot 12.56 acres of land at a 75 percent subsidised cost for the project, which will come up in the Naidupeta Industrial Area, strategically located near Chennai, Tamil Nadu.

The facility is scheduled to be operational by October 2026 and is projected to contribute about Rs. 6,200 crore to Syrma SGS’s revenue in FY27. The plant will comprise three distinct units: one for single-layer, multi-layer, and HDI/flexible PCBs; another for copper clad laminate (CCL) production; and a third for electronics manufacturing services.

Syrma SGS plans to invest Rs. 1,595 crore in the project, which will be developed in collaboration with South Korea’s Shinhyup Electronics. As per the proposal submitted to the state government, the venture will operate under a 51:49 equity partnership between Syrma SGS and Shinhyup Electronics.

Additionally, on 2nd September, Syrma SGS announced the signing of a JV agreement with Italy-based Elemaster S.p.A Tecnologie Elettroniche, a global electronics design and manufacturing leader. The JV will set up a facility with an initial investment of Rs. 55 crore, and is projected to deliver around Rs. 200 crore in revenue by FY27.

The JV, to be operated through Syrma SGS Design and Manufacturing Private Limited (to be renamed as Syrma SGS Elemaster Private Limited), will focus on creating an India-centric platform catering to high-reliability clients in the railway, industrial, and medical electronics segments. The facility will be located at Bommasandra Industrial Area, Bengaluru, with an initial footprint of ~20,000 sq. ft., configured for SMT, THT, and box-build assembly lines.

The company’s Executive Chairman, Sandeep Tandon, projected that peak revenues could touch ~Rs. 400 crore by FY28, with nearly half anticipated by FY27. He noted that despite margin pressures in India, profitability is expected to remain in the double-digit range.

Financials & more

Syrma SGS reported a decline in its revenue from operations, showing a year-on-year decrease of around 19 percent from Rs. 1,160 crores in Q1 FY25 to Rs. 944 crores in Q1 FY26. In contrast, its net profit increased during the same period from Rs. 20 crores to Rs. 50 crores, representing an impressive rise of about 150 percent YoY.

Syrma SGS Technology Limited is engaged in the business of manufacturing various electronic sub-assemblies, assemblies, and box builds, disk drives, memory modules, power supplies/adapters, fibre optic assemblies, magnetic induction coils, and Radio Frequency Identification (RFID) products, and other electronic products. The Company has five state-of-the-art manufacturing facilities, most of which hold all key accreditations required for the industry.

Written by Shivani Singh

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.