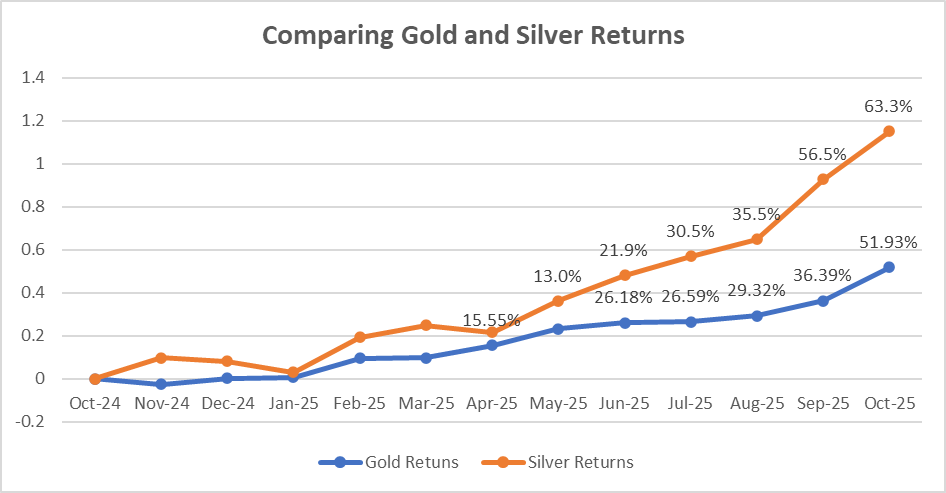

Synopsis– Want to know what’s delivering bigger returns right now? It’s not gold! We’re diving deep into silver’s massive price surge, breaking down the key factors driving its outperformance, and looking at the best ways for you to jump into this metal’s rally.

If you’ve been watching the markets, you know that gold and silver are on an absolute tear. The precious metals sector is on fire. As of today, gold has rocketed past ₹1,24,000 per 10 grams, delivering a stunning 50.1% gain so far this year (2025). Silver has actually done better! It’s currently up an incredible 63.4%, crossing ₹1,67,000 per kilogram. That’s right, So Why is the price of silver spiking so dramatically, and what’s the smartest way to invest in it right now?

Price comparison

| Metal | 1st October 2024 | 1st October 2025 |

| Gold 22k ( per 10 gram) | ₹71,650 | ₹1,08,020 |

| Silver ( per 10 gram) | ₹910 | ₹ 1,484 |

As you can see, the return on silver is a jaw-dropping over 63%, handily beating gold’s still-fantastic over 50%

Reason for Increase in Silver Price

- Industrial Demand: Unlike gold, silver is a critical industrial metal. Demand from Electric Vehicles (EVs), solar panels, and general electronics (the “green technology” movement) is surging so fast that silver mining simply can’t keep up. Supply deficit!

- A Supply Chain Bottleneck: Silver is a persistent supply deficit in silver production, largely because silver is often produced as a byproduct of other base metals mining, limiting its availability

- Geopolitical Tension: Economic uncertainty has attracted investors to silver because of geopolitical issues as a store of value.

- Interest rate cuts by the U.S. The Federal Reserve has boosted demand for non-yielding metals like silver.

- Local Currency Woes: The weakening of the Indian Rupee against the U.S. Dollar makes imported commodities, including silver more expensive in the local market, driving up the price you see at the jewelers.

- Momentum and Speculation: Investors are increasingly using silver ETFs and physical silver to diversify their portfolios. The metal’s famous volatility (it moves more sharply than gold) is attracting momentum traders looking for big, fast gains.

All these powerful factors combined are what have pushed silver prices up by over 63% in just one year.

Also read: Gold Prices on the Rise: Can 10g Gold Reach ₹2 Lakh in Next 5 Years?

The Smartest Ways to Invest in Silver

1. Silver Exchange Traded Funds (ETFs):

- Why it works: This is the simplest and most cost-effective path, especially for Indian investors. You get excellent liquidity, low expense ratios, and you completely skip the worry about storage or whether your bar is 99.9% pure.

- The Bonus: They allow you to invest systematically, like doing a monthly SIP, making diversification incredibly easy. They track the domestic silver price and guarantee high purity.

2. Digital Silver:

- Platforms like eBullion let you buy digital silver. You can buy tiny amounts, enjoy instant liquidity, and benefit from guaranteed high purity (99.99%), all while the metal sits securely in a vault.

3. Physical Silver:

- Buying physical things like coins, bars, or even jewelry. The traditional way to hold tangible wealth, but remember the trade-offs storage, insurance, and verifying purity when you buy or sell.

4. Silver Mutual Funds:

- This is an indirect way to invest, where a fund manager focuses on assets related to the silver market. It’s ideal for people who want exposure to the metal’s performance without any of the physical or purity concerns.

Gold or Silver; Which One is Better?

| Parameters | Gold | Silver |

| Price Stability | More stable, less volatile | More Volatile and price swings large |

| Average Annual Return | Around 10.6% | Around 7.6% historically |

| Price Fluctuations | Lower- 14.7% | Higher- 26.6% |

| Demand Driver | Jewelry,safe haven, reserves | Jewelry+ significant industrial use( EVs, electronics, solar) |

| Investment Purpose | Stability, inflation hedge, safe haven | Growth potential, economic recovery plays |

| Industrial Exposure | Low | High |

| Portfolio Role | Powerful diversifier, steady store of value | More dynamic, riskier growth asset |

Gold is still the foundation of any portfolio, your key anchor for preservation and stability. Silver is the dynamo growth engine, with high-octane promise for the investor brave enough to surf the tidal waves. The truly smart move isn’t to opt for one but to balance the other. By utilizing the tried-and-true safety of gold and the strong potential for gain of silver, you’ll have a portfolio that’s strong for bad times and good for good times.

Conclusion

Silver has surged well ahead of gold by virtue of pure returns in the span of only one year. That win is driven by a triple threat consisting of exploding industrial demand, supply bottlenecks, as well as plain old market momentum.

Written by Yatheendra N