Synopsis:

YOGI Limited has received a domestic purchase order worth Rs.37.54 crores from Companion Vinimay Trading Private Limited to supply industrial components.

The shares of leading real estate developers came into focus after receiving a purchase order worth Rs.37.54 crores With the market capitalization of Rs.516 crore, the shares of YOGI Limited closed at Rs.172, up by 1.18 percent from its previous day’s closing price of Rs.170 per equity share.

Purchase Order

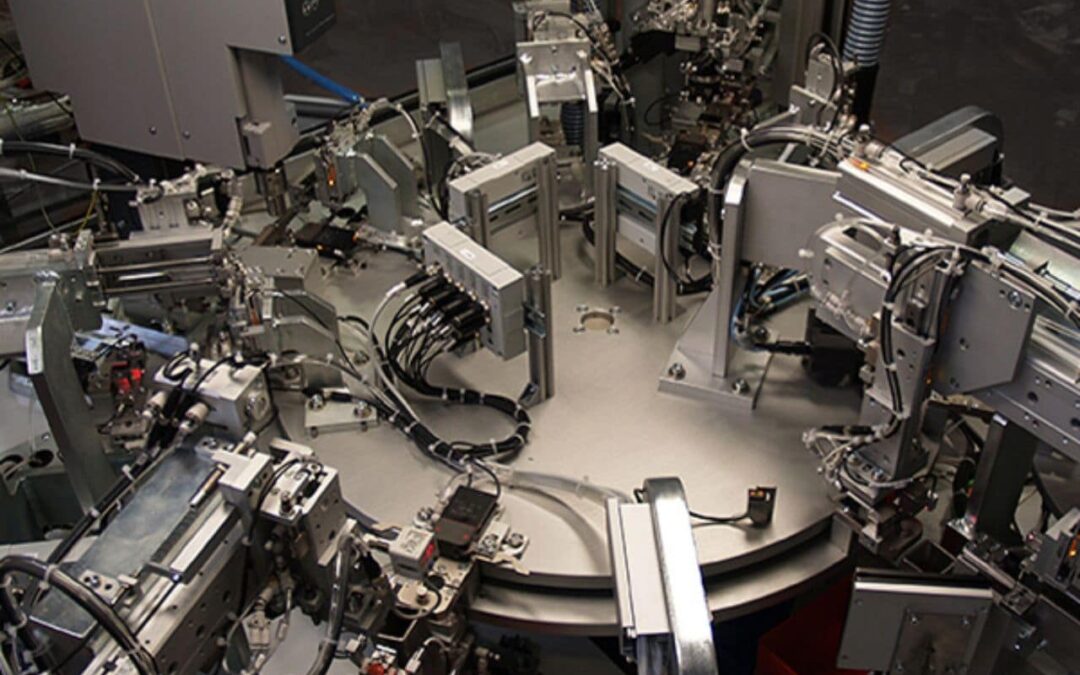

YOGI Limited has received a domestic purchase order worth Rs.37.54 crores from Companion Vinimay Trading Private Limited. The order involves supplying various industrial components such as structure assemblies, head assemblies, rotary tables, electrical accessories, tool changers, additional axes, and other related items. The company is expected to complete the delivery within 15 days. Both parties have agreed on the contract terms, including quality standards, delivery schedule, and pricing.

Also Read: Microcap IT stock in focus after receiving ₹27 Cr order for software licensing & installation services

About the Company & Others

YOGI Limited is a leading construction and real estate developer in Mumbai, consistently prioritizing quality, safety, health, and environmental standards. It has built on the expertise of a dedicated team, and the company has earned a strong reputation for delivering exceptional living and working spaces.

With years of experience in the industry, it focuses on timely project completion while enhancing the value and appeal of properties. Clients appreciate the company’s commitment to quality, punctual delivery, excellent customer service, and the professional approach of its experienced management, making it a trusted choice in the real estate sector.

In Q1FY26, the company reported operating revenue of Rs.90.29 crore, compared to no revenue in Q1FY25. It also moved from a loss of Rs.0.16 crore in the same quarter last year to a net profit of Rs.6.32 crore.

The company’s return on equity stood at 1.73 percent and return on capital employed at 1.92 percent. The stock is trading at a P/E ratio of 511.41, which is significantly higher than the industry average of 22.94.

Written By Jhanavi Sivakumar

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.