Syrma Sgs Tech IPO Review: After a pause for months, an IPO is back in the Indian markets. Syrma Sgs Technology Limited is coming up with its Initial Public Offering. The IPO will open for subscription on August 12th, 2022, and close on August 18th, 2022.

It is looking to raise Rs. 840 Crores out of which Rs. 766 Crores will be a fresh issue and the remaining Rs. 74 Crores will be an offer for sale. In this article, we will look at the Syrma Sgs Technology Limited IPO Review 2022 and analyze its strengths and weaknesses. Keep reading to find out!

Table of Contents

Syrma Sgs Tech IPO Review – About The Company

Syrma Sgs Technology Limited is a technology-focused engineering and design company engaged in turnkey electronics manufacturing services (“EMS”), specializing in precision manufacturing. Its diverse end-user industries, include industrial appliances, automotive, healthcare, consumer products, and IT industries.

According to the F&S Report, it is one of the fastest-growing Indian EMS players in India. In fact, It is one of India’s leading exporters of electronics, providing a high-value integrated design and production solution for internationally recognized OEMs.

The company currently operates through eleven strategically located manufacturing facilities in Himachal Pradesh, Haryana and Uttar Pradesh, Tamil Nadu, and Karnataka.

Their products are distributed in India and overseas, in over 19 countries, including the USA, Germany, Austria, and the UK.

The product portfolio of the company includes:

- Printed circuit board assemblies (“PCBA”)

- Radiofrequency identification (“RFID”)

- Electromagnetic and electromechanical parts

- Motherboards

- Memory products – DRAM modules, solid state, and USB drives.

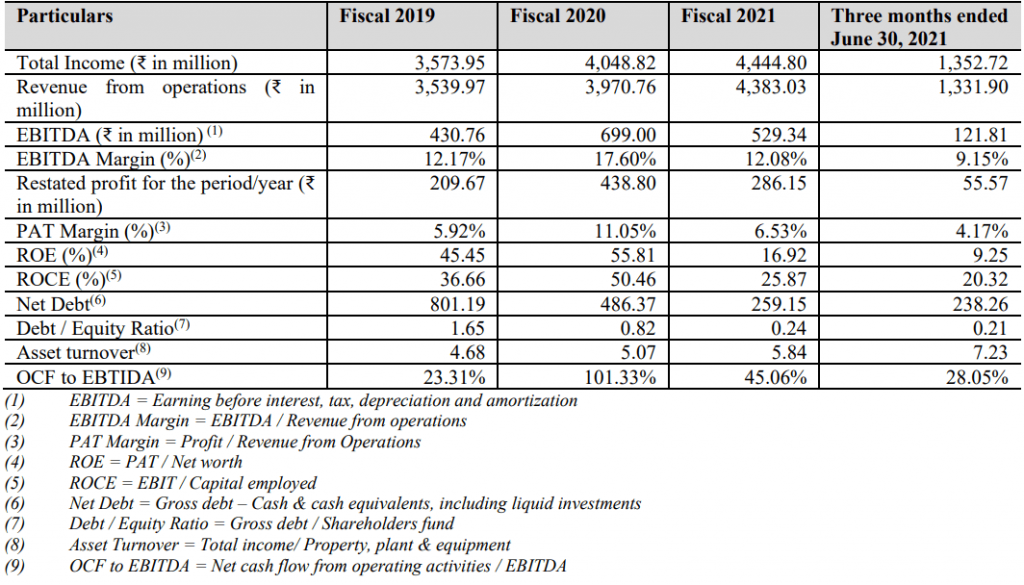

Syrma Sgs Tech IPO Review – Financial Highlights

(Source: DRHP of the company)

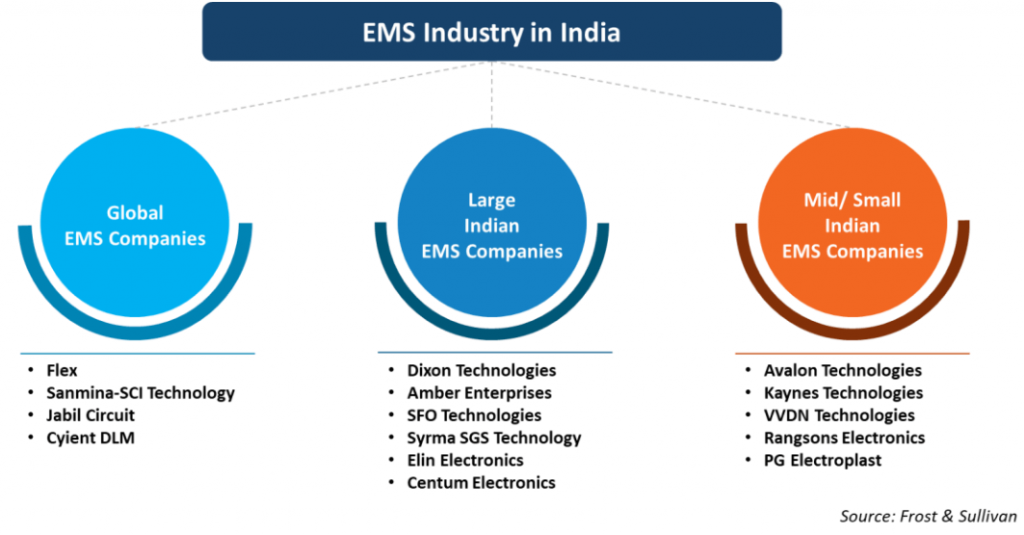

Syrma Sgs Tech IPO Review – Competitors

(Source: DRHP of the company)

Syrma Sgs Tech IPO Review – Industry Overview

Electronics production in India is estimated at ₹ 4,975 Billion (USD 67 Billion) in FY21 and is expected to grow at a CAGR of 32.3% to reach ₹ 20,133 Billion (USD 272 Billion) by FY26.

The total addressable EMS market in India was valued at ₹ 2,654 billion (USD 36 Billion) in FY21 and is expected to grow to ₹ 9,963 Billion (USD 135 Billion) in FY26 with a CAGR of 30.3%.

A Production Linked Incentive (PLI) Scheme was announced in 2019 considering the incremental investment and sales of manufactured goods specifically to the mobile phones and components market in India. In this, total production of ₹ 11,500 Billion is expected including ₹ 7,000 Billion in exports in the next five years.

In addition to that, the China + 1 Strategy has led the major end-user companies across the globe to look for companies having similar prices, quality, and receptiveness outside of China.

Strengths of the Company

- It is one of the leading design and electronic manufacturing services companies in terms of revenue in Fiscal 2021.

- The company was the first in India to manufacture Radio Frequency Identification (RFID) products in India and continues to lead the industry.

- The company has a long-standing relationship with customers like TVS Motor Company Limited, Eureka Forbes Limited, CyanConnode Limited, and Total Power Europe B.V.

- The company has State-of-the-art manufacturing capabilities supported by a global supplier network, with a focus on vertical integration.

- Experienced promoters supported by a senior management team with a proven track record of performance.

Weaknesses of the Company

- The company is expected to adhere to high quality given the nature of its products. Any deviation can adversely affect their brand name and reputation.

- Global factors like Import and export regulations, Foreign exchange controls and tax rates, and Foreign currency exchange rate fluctuations can affect the business.

- Cyber risk and the failure to maintain the integrity of their security systems or infrastructure, or those of their clients could have a material adverse effect.

- The company operates in a highly competitive environment. Any new entrant can posses a threat to their business.

- There are certain outstanding legal proceedings against the Company, its Directors, Promoters, and some of their Subsidiaries.

Syrma Sgs Tech IPO Review – Grey Market Information

The shares of Syrma Sgs Technology traded at a premium of 13.64% in the grey market on August 9th. The shares tarded at Rs 250. This gives it a premium of Rs 30 per share over the cap price of Rs 220.

Syrma Sgs Tech IPO Review – Key IPO Information

Promoters: Sandeep Tandon, Jasbir Singh Gujral, Veena Kumari Tandon, And Tancom Electronics Private Limited

Book Running Lead Managers: DAM Capital Advisors Limited, ICICI Securities Limited, and IIFL Securities Limited

Registrar To The Offer: Link Intime India Private Limited

| Particulars | Details |

|---|---|

| IPO Size | Rs 840 Crores |

| Fresh Issue | Rs 766 Crores |

| Offer for Sale (OFS) | Rs 74 Crores |

| Opening date | August 12, 2022 |

| Closing date | August 18, 2022 |

| Face Value | ₹10 per share |

| Price Band | ₹209 to ₹220 per share |

| Lot Size | 68 Shares |

| Minimum Lot Size | 1 (68 shares) |

| Maximum Lot Size | 13 (884 shares) |

| Listing Date | August 26, 2022 |

The Objective of the Issue

The Net Proceeds from the Fresh Issue are proposed to be utilized for:

- Funding capital expenditure requirements for the development of an R&D facility and expansion / setting up of manufacturing facilities,

- Funding long-term working capital requirements, and

- General corporate purposes

In Closing

In this article, we looked at the details of Syrma Sgs Technology Limited IPO Review 2022. Analysts remain divided on the IPO and its potential gains. This is a good opportunity for the investors to look into the company and analyze its strengths and weaknesses. That’s it for this post.

Are you applying for the IPO? Let us know in the comments below.

You can now get the latest updates in the stock market on Trade Brains News and you can even use our Trade Brains Portal for fundamental analysis of your favourite stocks.