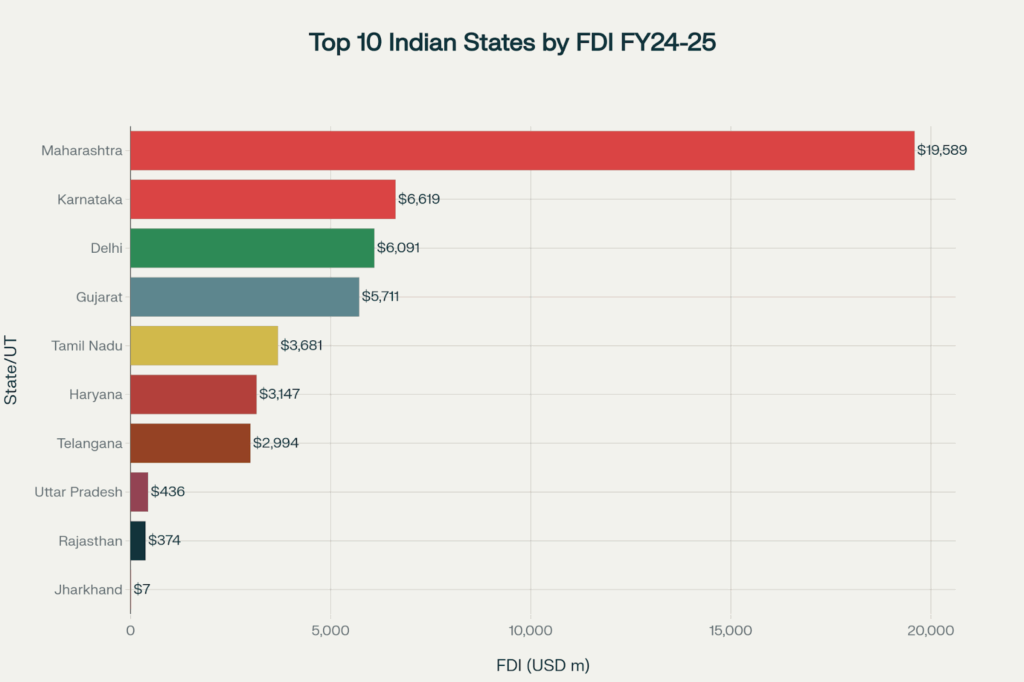

Synopsis: In FY 2024-25, India attracted a record USD 81.04 billion in FDI, marking 14% growth from the previous year, led by Maharashtra, Karnataka, and Delhi.

In FY 2024-25, India celebrated an historic milestone by attracting USD 81.04 billion in Foreign Direct Investment, an approximate 14% increase over the previous year’s USD 71.28 billion. Maharashtra stood first with 39% of the total FDI inflows, followed by Karnataka with 13% and Delhi 12%. This impressive growth indicates the improved status of India as an investment destination in the global scenario due to its various policy improvements, better business environment and strategic sector liberalization in the manufacturing, services and technology sectors. The article highlights the leaders and growth drivers for increase in FDI.

1. Maharashtra

Maharashtra leads the FDI list in India with an overpowering inflows of USD 19.59 billion making up 39% of the total FDIs of India. The state has been dominating because of its strong industrial infrastructure, central location, and its extensive ecosystem which covers the full extent of manufacturing and the modern technology areas. Mumbai is also the financial capital, which serves as a gateway to international investors, offering services through the banking, legal and professional service as well as other services that facilitate smooth business operations.

2. Karnataka

Karnataka ranked second with USD 6.62 billion worth of the capital flows reflecting 13 % of the total foreign investment into India. Known globally as India Silicon Valley, Bengaluru has earned a reputable name in the field of technology, biotechnology and aerospace. Bangalore, the state capital, is home to many multinational corporations and has become a preferred destination for research and development activities.

3. Delhi

Delhi, the national capital, attracted USD 6.09 billion through FDI, representing 12% of total investment. The exceptional advantage that the state enjoys as the political center gives an investor the proximity to the policy makers and regulatory authorities, which allows them to conduct business more effectively and make strategic decisions faster.

Also read: India’s 6 Most Expensive Cities to Live In (2025) – See Where Yours Ranks

4. Gujarat

Gujarat, known as the manufacturing hub of India as it received USD 5.71 billion, representing 11.4% share of the total FDI. Its investor friendly policies, the presence of a quality port infrastructure, and its strategic location at the western coast of India make it a perfect destination to develop export oriented industries and logistic operations.

5. Tamil Nadu

Tamil Nadu accounted for USD 3.68 billion of foreign investment which constituted 7.4 percent of the total FDI of India. The state has a blend of manufacturing strength with a rising services sector skills especially in information technology and the automotive sectors. Chennai, also referred to as the Detroit of India has several automobile manufacturer and component suppliers.

6. Haryana

Haryana is ranked sixth with a foreign investment of USD 3.15billion which corresponds to 6.3 percent of all the foreign investment in India. This excellent geographical position of the state next to Delhi, and a well developed industrial and manufacturing base has made the state a favourable place for investments.

7. Telangana

Telangana received USD 2.99 billion in FDI making 6% of total inflows. The state has established itself as a major hub of pharmaceuticals, biotechnology, and IT industry, largely driven by state capital, Hyderabad.

Also read: 3 Industrial Corridor Projects That Could Transform Bengaluru’s Real Estate Forever – See the List

8. Uttar Pradesh

Uttar Pradesh is ranked in the eighth spot with the USD 436 million inflows of FDI. The state is attracting foreign investors due to its ambitious nature of development and improved infrastructure.

9. Rajasthan

Rajasthan is ranked ninth with FDI inflows of USD 374 million. Renewable energy, tourism, and its rich mineral reserves are the major foreign capital attractions in the state.

10. Jharkhand

Jharkhand ranks tenth in the list with FDI flows of USD 7 million. The state has a rich investment portfolio characterized by its mineral reserves, especially in coal, iron ore and copper.

Top 10 States with the Highest FDI in FY 2024-25

Sectoral Distribution and Growth Drivers

The services sector was the leading destination of the FDI equity inflows in FY 2024-25 that received 19% or USD 9.35 billion worth of investments, an increase of 40.77% compared to previous year. This trend indicates the dominance of India as a destination of services delivery across the entire spectrum including IT services, financial services, consulting, and business process management.

The Computer software and hardware sector attracted 16% of the overall FDI inflows whereas trading stood at 8%. The manufacturing industry recorded a remarkable growth of 18% to gain USD 19.04 billion up against USD 16.12 billion during the previous financial year. This growth demonstrates the fact that India is now positioned as an international manufacturing destination with initiatives like Make in India and Production-Linked- Incentive programs.

Global Investment Sources and Diversification

The FDI base of investors in India has also been diversified with 112 countries in the current fiscal year 2024-25 compared to 89 countries in the fiscal year 2013-14. Singapore remains the number one source country with 30% of the total FDI, followed by Mauritius 17%, and the United States 11%. This diversification lowers reliance on traditional sources of investments and reflects increasing attraction of India across geographies and to various types of investors.

Policy Reforms and Future Outlook

To ensure that FDI continues to grow, the Indian government has provided radical policy changes such as liberalization of sectoral caps, simplifying the approval procedures, and new investment friendly policies. In strategic industries like coal mining, contract manufacturing, 100% FDI has been opened up, and the 2025 Union Budget has proposed raising FDI limits in insurance from 74% to 100%.

Final Thoughts

India achieving the USD 81.04 billion milestone in FDI in the FY 2024-25 is not merely eye-catching figures, it represents the country’s transformation into a preferred global investment. More than 96% of FDI is concentrated in the top 10 states shows the strength of the major investment centers but a necessity to diversify and spread the geography of foreign investment. With an approved policy and sustained increase in FDI inflows, improved business environment and strategic policy reforms, India is positioned to attract more share of the global investment flows in the coming years as the country forges ahead in becoming a USD 5 trillion economy.

Written by Prajwal Hegde