Synopsis– Find out the top Tier-2 and Tier-3 cities in India that promise attractive rental yields in 2025. From emerging business hubs to fast-growing residential markets, find out where your next property investment could pay off big.

India’s property market is changing gears in 2025, as Tier-2 and Tier-3 cities take center stage for investors seeking steady income. While Tier-1 cities such as Mumbai are plateauing at 2–3% yields, these new-age cities are offering 3–7% yields, driven by infrastructure developments, IT hubs, and migration. Residential sales across Tier-2/3 cities rose 20% YoY to ₹1.2 lakh crore in H1 2025, with yields hovering between 4.5–5.5%—higher than the national average of 4.8%. According to reports from top property consultants, here’s a list of the top 10 Tier-2/3 cities delivering high rental yields, with affordable entry points (₹50–80 lakh for 2BHKs) and 10–15% appreciation potential.

1. Thane

- Yield Snapshot: 4–7%; Average rent of ₹30,000 in Ghodbunder

- Reasons to Invest: Affordable proximity to Mumbai with 95% occupancy; ideal for families

- Key Drivers: New metro lines and Ghodbunder Road upgrades that slash commute times

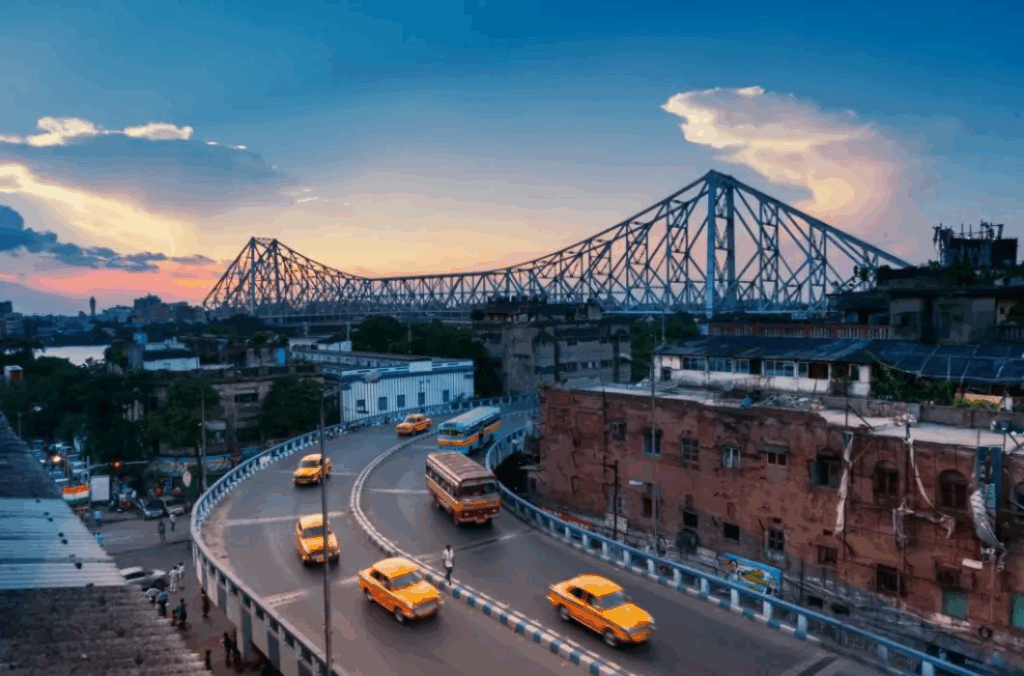

2. Kolkata

- Yield Snapshot: 3.5–6.3%; Average rent of ₹25,000 for a 2BHK

- Reasons to Invest: The IT and education boom is attracting young tenants, with rents in New Town rising 25%.

- Major Factor: Metro expansion and IT parks in Salt Lake are driving demand.

3. Surat

- Yield Snapshot: Up to 6%; Average rent ranges from ₹20,000–₹28,000.

- Reasons to Invest: Affluence from the diamond trade is driving luxury rentals, with a 30% YoY rise in rents.

- Major Factors: Diamond Bourse and Surat Metro are attracting international businesses.

4. Chandigarh

- Yield Snapshot: Up to 6%; Average rent of ₹22,000 for high-end units.

- Reasons to Invest: Growing prosperity is attracting professionals, while IT hub Mohali ensures steady rentals.

- Key Drivers: Pre-planned infrastructure and proximity to Delhi add cross-border appeal.

Also read: Bengaluru vs Mumbai Micro-Markets: Where Should You Invest in 2025?

5. Coimbatore

- Yield Snapshot: Up to 5%; Average rent ranges from ₹18,000–₹25,000 in Coimbatore.

- Reasons to Invest: The industrial–IT mix is set to ensure easy tenancies in the coming year, with prices already up 16.7%.

- Key Drivers: TIDEL Park and the Avinashi Flyover will further boost the area’s connectivity.

6. Kochi

- Yield Snapshot: 3–5%; average rent of ₹22,000 in Kakkanad.

- Reasons to Invest: Seasonal demand driven by tourism and NRI inflows, coupled with benefits from the Smart City initiative.

- Key Drivers: The Kochi Water Metro and Phase 2 renovations of the airport will significantly improve accessibility.

7. Indore

- Yield Snapshot: 4–5.5%; average rent ranges from ₹15,000–₹20,000.

- Reasons to Invest: The city’s “Clean City” status attracts families, students, and professionals, with prices appreciating 16.7%.

- Key Drivers: Expansion of the Yellow Line Metro and the Super Corridor is enhancing connectivity for IT hubs.

Also read: Top 5 Indian States That Recorded the Highest Digital Transactions in August 2025

8. Lucknow

- Yield Snapshot: 3.5–4.5%; average rent of ₹16,000 in Gomti Nagar.

- Reasons to Invest: Affordable luxury attracts government employees, with a 20% increase in demand.

- Key Drivers: Metro Phase 2 and airport upgrades act as catalysts for migration.

9. Ahmedabad

- Yield Snapshot: 3.9–4.1%; average rent of around ₹20,000 along SG Highway.

- Reasons to Invest: Low entry price (₹60 lakh on average), with prices expected to rise 25–30%, bringing rents closer to Tier-1 city levels.

- Key Drivers: GIFT City and anticipated bullet train projects are expected to drive commercial growth.

10. Trivandrum

- Yield Snapshot: Up to 4%; average rent of ₹18,000 near Technopark.

- Reasons to Invest: Emerging IT hub with low competition, offering stable rentals for families.

- Key Drivers: Expansion of the Digital Science Park and Kazhakkoottam area is enhancing growth potential.

Factors Driving High Rental Yields in Smaller Cities

The substantial rental yields in these cities are not accidental; they are a result of several strong economic and social factors:

- Economic Diversification: These cities are moving away from being reliant only on traditional industries. They are starting to transform into employment hubs for IT, manufacturing, education, and services, creating jobs and stimulating migrant employment.

- Low Property Prices: Property prices in Tier-2 and Tier-3 cities provide a very low entry barrier compared to major metros, where property prices are stratified. This enables investors to invest in property at a fraction of the cost and propels rental yield percentage.

- Improvement in Infrastructure: The Federal and Local governments are heavily investing in these cities by developing new airports, new expressways, and new metro. These projects will not only improve turns, but also stimulate economic activity and demand for real estate.

- Inflow of Migrants: Because corporations are moving operations to these cities to save business costs, which are also contributing to international students enrolling in top universities for employability purposes, this provides for a constant inflow of students and young workers, which creates a continuous and high demand for rental housing.

- Government Initiatives: The current policies, such as Make in India and Industrial Corridor Initiative, are contributing to manufacturing and industrial growth in these cities which helps with regional economies and real estate requirements.

Calculating Rental Yield: A Basic Overview

To understand the expected return on your investment you will first need to know how to calculate rental yield. The yield is represented as a percentage and can be measured in two different ways:

1. Gross Rental Yield: This is the simpler calculation and does not consider any expenses.

- Formula: (Annual Rental Income / Total Value of Property) x 100

- For example, if you purchased a property for ₹50 lakh, and earned ₹20,000 a month in rent, the annual income would be ₹2,40,000. (₹2,40,000 / ₹50,00,000) x 100 = 4.8%

2. Net Rental Yield: This gives a much better overall picture of realistically loose rental yield to calculating all annual expenses like taxes, property maintenance, and vacancy costs etc.

- Formula: ((Annual Rental Income – Annual Expenses) / Total Value of Property) x 100

- This metric however, is more relied upon for an advance calculation.

Conclusion

In 2025, Tier-2 and Tier-3 cities, such as Kolkata and Surat, present opportunities for yield sought investors as they stand to combine 4-6% returns & 12-18% appreciation with India achieving GDP growth of around 7%. Their proximity to owned/controlled Tier-1 cities combined with the decentralization of urbanization provides them with an additional buffer of resiliency against economic volatility, providing strategies for shorter response times with quick returns, through professional/student rentals. RERA (Real Estate Regulatory Authority) also provides adequate protections, while green development is also on the rise for additional options. Now is a time to invest in diverse locations: the key for maximum returns will be to penetrate micro-markets a short distance from established metros. Smart investments in Tier-2 and Tier-3 locations will represent not only cash-flowing assets, but the profitability of one’s vision for India’s next story of sustainable growth.

Written By Rachna Rajput