Since the start of this year, the Ruchi Soya share is rising continuously. And this resulted in most of the share market investors asking the same question: Is there a Secret Sauce due to which Ruchi’s shares increased +8,000% within 6 months? Before diving deeper into this topic, let’s try to understand the scenario of Ruchi Soya’s current share price with the help of a few examples.

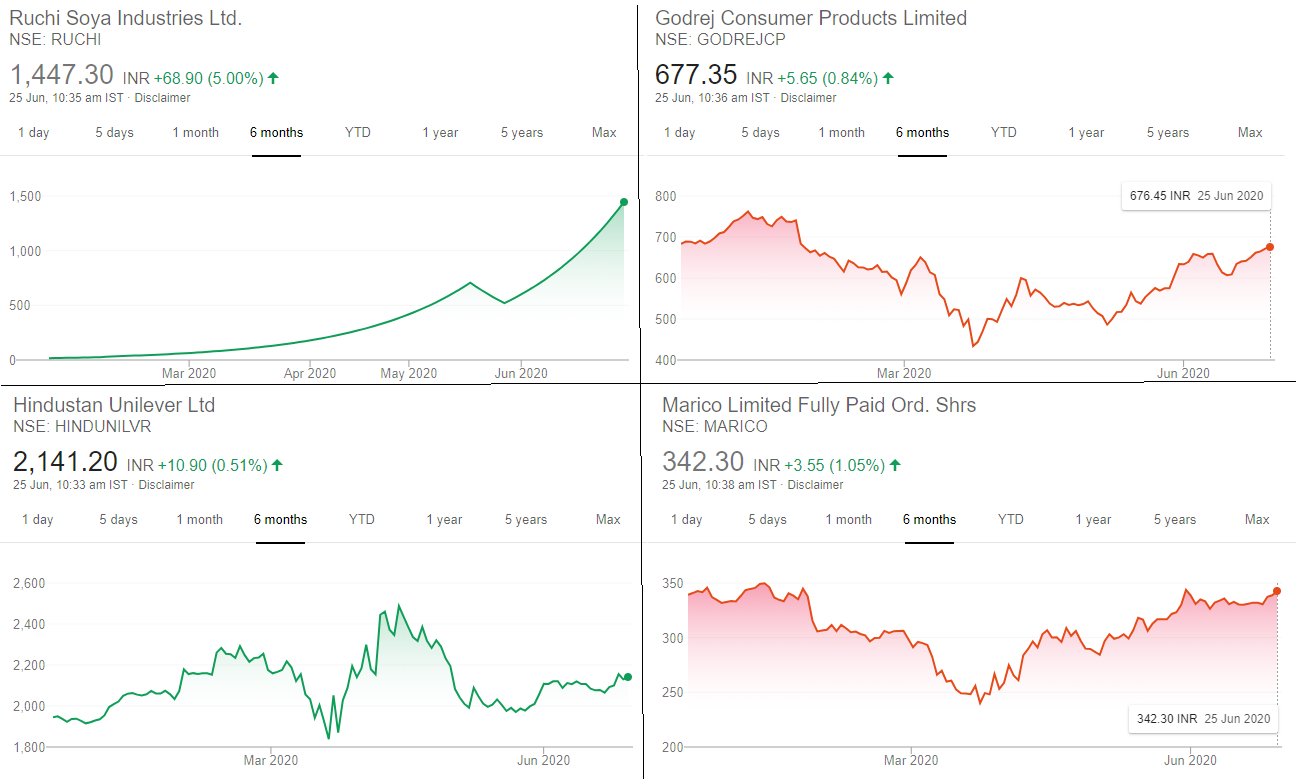

All the four graphs depicting share price movements shown below are from various leading stocks trading across different industries in the Indian stock markets. Can you find any anomaly in the share price movement of the below-shown shares?

Further, even if we look into the different companies in the FMCF sector, you can find one stock that is performing particularly irregular compared to others.

It takes only seconds for our eye to catch the outlier in both, the share of Ruchi Soya Industries Ltd. But what is even more surprising is that the smooth and slick 8000% upward price movement of the stock is during the times of corona. Today, we have a closer look at Ruchi Soya Industries Ltd in order to provide an insight into what actually has led to the 8000% price increase.

Table of Contents

Ruchi Soya Story till 2019

Ruchi Soya Industries Ltd. has been around for 34 years and is one of the largest manufacturers of edible oil in India. The shares of Ruchi Soya would be a dream stock prior to 2015 for any investor looking for dividends. This is because the company gave out dividends for 15 years consistently from 2001-2015.

Ruchi’s run, however, was cut short post-2015. The company made continuous losses in 2016,2017 and 2018. An extremely unhealthy sign for a company that has accumulated huge debt in its expansion goals. The huge debt of 12,000 crores forced Ruchi to enter the insolvency proceedings in December 2017.

— Post-Insolvency Performance of Ruchi Soya

The insolvency proceedings saw Ruchi being bid for. Here a portion of the amount bid would be used to pay off the debts and the remaining infused into Ruchi. Patanjali eventually won the bidding war against Adani. In December 2019 Patanjali completed the acquisition of Ruchi Soya with an Rs. 4350 crore resolution plan.

You may be wondering why would players take part in an aggressive bid war for a company that now had further deteriorated its sales and market grip by 2019. The answer to this lies in the already set up distribution channels and 3.3. Million tonnes per annum edible oil refining capacity in the 13 refining plants across the country. Five of these plants are port-based. The port-based refining plants are of huge significance as 70% of edible oil consumed in India is imported.

— Ruchi Soya’s Situation Post “Acquisition”

The shares of Ruchi Soya were delisted from November 2019 to 27th January 2020 due to the restructuring process. The restructuring process saw the dilution of the stake held by existing shareholders. Their shares were reduced 100:1. This can be described as a reverse stock split to understand better, where 100 shares held are now reduced to 1, but there was no Corporate Action. This was done in order to make way for Patanjali which now has an ownership of 99%.

Out of Patanjali’s total equity infusion, Rs450 crore was invested in exchange of preferential shares. Interestingly enough shares were also allotted to Ashav Advisory on a preferential basis in April. April was also the month where the shares of Ruchi Soya kept increasing from Rs.180 to Rs.413. The preference shares were allotted to Ashav Advisory at Rs.7 a piece in exchange for an Rs.1.87 crore investment after the company’s board approval.

Current Scenario of Ruchi Soya

The shares of Ruchi Ltd. were relisted on January 27th. The shares opened at Rs.17 but since then have been a nightmare for investors trying to get in on the action. Shares of Ruchi saw a continuous 5% increase every day. This has triggered the circuit breakers every day leading to the trading suspension of the shares on a daily basis.

This carried on for over a 100 day period until the shares touched Rs. 706.95. This was followed by a steady fall to Rs 519.80 which seemed like a market correction in order to touch an equilibrium price. But post-May 27th the 5% per day rally began once again. As of 24th June, the shares of Ruchi Ltd. have touched Rs. 1378.40, an 8008% increase in the value since January.

“ RSIL’s liquidity position also remains adequate as on 9MFY20, considering the absence of fixed debt obligations during FY21, a low average collection period, and the availability of unencumbered liquid 1 assets of over Rs. 380 Cr for meeting its required working capital needs.” –Brickworth rating.

Brickworth Rating agency assigned a stable outlook to the companies long term and short term borrowings this year.

Although the Preferential Shares allotment to Ashav Advisory is still pending due to Covid-19 they are still one of the biggest winners in the COVID-19 environment. Their 13 crore investment in April is now worth Rs.2577 crores

Reasons behind the 8,000% increase

The parade of Ruchi Soya has investors wishing they could somehow be a part of. The following reasons give an insight as to what were the reasons for the 8000% price increase. They would also help an observing investor take a better stand when it comes to the shares of Ruchi Soya.

— Baba Ramdev’s Vision in FMCG Industry

Patanjali first disrupted the FMCG segment when they bought their ayurvedic alternatives to the shelf. The Ayurvedic product giant now aims at completely dominating the FMCG segment in India. This would mean that Patanjali would have to take other giants like HUL head-on.

HUL in the year 2018-19 has had sales crossing over 37000 crores. Ruchi would play a crucial role in achieving this. But Patanjali however does not only aim at beating current FMCG market leaders but is aimed at per annum sales of Rs. 100,000 crores in the next two years. Current market leaders like HUL, Nestle, Procter and Gamble, Britannia, and ITC in the 320,000 crore FMCG market get over 75% of their sales from the conventional distribution channels. Whereas Patanjali, on the other hand, receives 70% of its sales from its branded franchise outlets.

Patanjali has set a target of increasing the current 5000 distributors to 25000 distributors in the next 2 years in order to achieve their sales goals. Analysts have predicted that Patanjali can achieve their 1 lakh crore sales targets by expanding their retail reach alone. In addition, Ruchi, which is part of these goals has been debt-free ever since its acquisition by Patanjali.

— Minuscule Public Shareholding and Lack of Share Supply.

(Source: Latest Shareholding Pattern of Ruchi Soya)

Post the restructuring that took place after Patanjali’s acquisition reduced the shareholding with the public shareholders by 99%. Patanjali currently owns up to 99% of the equity shares with less than 1% remaining with the public shareholders. This means that only 28.59 lakh of the 29.59 crore shares of Patanjali are held by the public. This has created a situation where there is a huge demand for investors but the supply available of shareholders willing to sell is too low.

(The graph above shows the trading volumes of the shares of Ruchi Soya Industries Ltd. This shows the lack of significant trading volumes post-February 2020: Source)

The huge increase in the share price has caused the market cap. of Ruchi to increase from Rs. 4350 crore when Patanjali bought it to 40,447.38 crores as of 24th July. Putting it at par with other giants like PNB, DLF, Cipla, etc.

This, however, raises the question as to how has Patanjali been able to legally hold 99% of the shareholding. This is because as per market regulations any majority stakeholder of a listed company cannot hold more than the permissible limit of 75%. Patanjali, however, is part of an exception as Ruchi Soya has just come out of the bankruptcy courts. Patanjali, however, has announced that they will be selling off 20-25% of their stake within the company over the next two years.

Closing Thoughts

The stocks of Ruchi Soya have been one of the biggest silver linings present in the Indian stock markets in the COVID-19 environment. But the question remains whether Ruchi will continue to be the diamond with demand exceeding the supply in the coming years. Investors after conclusively making a decision to get in will also have to decide the right time to do so.

The periods lie in either the current rally in order to be part of the Ramdev vision of which Ruchi is a part. Or to invest when Patanjali finally lets go of the 20-25% over the next 2 years when the supply will also be increased which in turn will affect the price. At the same time get an insight into role played and performance of Ruchi under Patanjali. Happy Investing!

Aron, Bachelors in Commerce from Mangalore University, entered the world of Equity research to explore his interests in financial markets. Outside of work, you can catch him binging on a show, supporting RCB, and dreaming of visiting Kasol soon. He also believes that eating kid’s ice-cream is the best way to teach them taxes.