Synopsis- The residential launches in North Bengaluru during Q3 2025 increased by 60%, supported mainly by the Yelahanka, and 2 other areas. Infrastructure improvements, job creation and affordability have propelled the growth of these North Bengaluru areas with potential for great investment returns in future.

The 60% Surge Spotlight: Northern Bengaluru Takes the Centre Stage

- Devanahalli’s Airport Influence: Captured about 40% of Northern launches, with a price increase of 133% post-Covid to ₹9,000-13,500/sq ft (1% QoQ and 7% YoY). Devanahalli’s market share of ~60% speaks affirmatively to the airport’s initial impact on price.

- Yelahanka’s Attractive Growth: Yelahanka contributed 15-20%, with price increases of 25% in 2025 to ₹6,300-7,800/sq ft (2% QoQ and 7% YoY) appealing to a key mid-segment family audience.

- Thanisandra Road’s Rising Favor: Amounting to 10-15%, an increase of 2% QoQ to ₹6,300-7,800 sq ft, the tract focuses on units ~1,600-2,000 sq ft for a younger professional local audience, according to the report.

East Bengaluru Areas like Whitefield and Old Madras Road contributed 18% of the quarterly launches. Whereas South Bengaluru areas like Electronic City, HSR Extension, Kanakapura Road and Sarjapur Road accounted 19% of the quarterly launches.

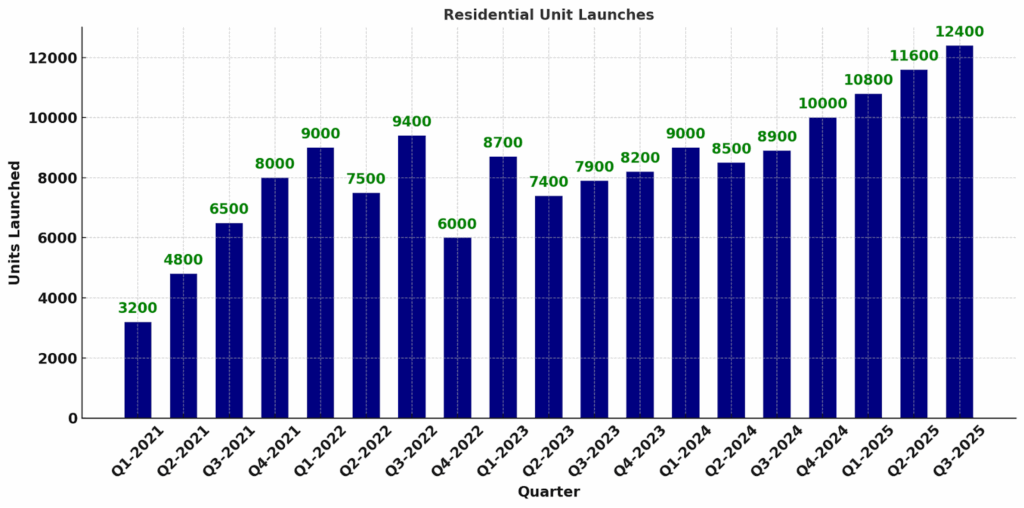

The graph displays values of residential unit launches for Q1 2021 to Q3 2025. The value has increased throughout the years, from below 5,000+ units at the beginning of 2021 to over 12,000 units in Q3 2025. There were declines in unit launches in 2022 and 2023, however, the overall trajectory has increased, even with many value dips. The 2025 increases were significant, particularly Q2 and Q3. This highlights the increase in real estate activity in North Bengaluru, which is due most likely to improvements in infrastructure and increasing buyer confidence.

Also read: Top 7 Commercial Hotspots in India Promising High Rental Yields in 2025

Reasons Behind the Surge: Infrastructure, Jobs and Swing in Buyers

- Infrastructure Developments: Kempegowda Airport expansions and Namma Metro 2 (72km long) connecting Airport to Central Bengaluru. The Peripheral Ring Road (75 km long) and other connecting arterial roads will improve access, driving a projected 30% increase by 2030. The Metro Blue Line connecting Kempegowda International Airport to Silk Board is boosting property value.

- Job Growth & GCC Influx: Over 50,000 IT/GCC jobs during Q3 (Manyata/KIADB parks in North Bengaluru) draw millennials (55% + of buyers) and the hybrid work model favours green North Bengaluru 20% more demand than South Bengaluru, according to Godrej Properties.

- Affordable Entry & Lifestyle Appeal: Entry prices 20% lower compared to East/South Bengaluru ₹6300-13,500/sq ft) are generating higher ROIs of 10-15% and quiet hills/farms are seen as appealing to urban escapists mid segment sales were up 22% QoQ.

- Festive & Economic Momentum: Incentives pre-Diwali (5-10% discount) and stable economy (7.8% GDP, 2.07% CPI) meant revival of consumption by 15% (QoQ)—once again the report notes festive anticipation as the main driver.

Projects Structuring the Surge: Mega-Launches Stealing the Show

- Sattva Hamlet (Devanahalli): 3,460 units (690 -2,895 sq ft) by Salarpuria Sattva airport adjacent sovereign gated township was able to compete with parks, and clubs and drew 30% of the submarket to sales.

- Nikoo Garden Estate (Devanahalli): 1,850 units (793-2,504 sq ft), by Bhartiya City luxury eco homes with lagoons increased the high-end segment share to 51% of all sales.

- Shriram WYTField Phase 2 (Budigere Cross near Thanisandra Road): 592 Units (745- 1,055 sq ft) by Shriram Properties mid-segment focus helped increase overall share.

These projects (aggregate of over seven thousand units) have drawn inventory down to 18 months, according to Cushman & Wakefield.

Comparison Insights: North v South/East – Why North Wins

- Growth v Saturation: North is 40% YTD (up from 30% in 2024) v South being mature at 42%. With prices in North being lower (20% cheaper), ROI 10-15% higher by Godrej MSR City.

- Infrastructure Improvement: Airport/Metro vs Traffic Issues in South- North is 25% more convenient. North is drawing young buyers (55%) vs East at 16% because of oversupply.

- Demand Diversification: North is mid-high mix (51% luxury and 49% mid) vs South more premium mix (60% being high-end) and forcing out the mid-market. North 22% mid growth QoQ v national (9%).

- Future ROI: By 2030, North projections 25% vs East (15% saturation if IT) per Listifyi.

Golden Opportunity for Investors

For smart investors looking for 10-15% yields:

- Buy early in North: Look for Devanahalli for 133% appreciation potential; or Yelahanka/Thanisandra area for steady rents at 7% YoY (₹72,000-210,000)/month.

- Segment Diversification: A blend of the mid-price segment accounts for 49% of shares among quick flips, and the luxury segment accounts for 51% premium in essence, leveraging the festive deals from 5% 10% cashback.

- Infrastructure-Risk Hedge: Please prioritize airport/Metro adjacent space 18 months of inventory shows we’ve got little inventory; could capture 4% to 5% yields on solid rentals.

- Longer Term Play: North will boom with all the new GCCs, promoting liquidity. Offering a REIT as an entry opportunity without the need for full ownership.

Future Outlook

The short-term outlook (next 3-6 months) for Bengaluru looks positive this is mainly driven by the expected boost due to the festive season. The total starts YTD 2025 showed 37,103 units, representing a 33% YoY increase, to put the total launches on target for record annual launches. The North submarket is likely to continue its high growth trajectory due to its strategic firm outlook and pipeline of high-end projects, confirming itself as the primary high-growth location for new supply in the Bengaluru marketplace.

Conclusion

The 60% Q3 surge in Devanahalli, Yelahanka, and Thanisandra redefines Bengaluru’s realty map The intersection of infra magic + jobs dynamite + lifestyle charm = the launch bonanza. As North challenges South/East for best ROI; Investors; Get in for 10%-15% up front festive momentum and economic tailwinds will create a sustainable capital spark. Mumbai and the North area of Bengaluru aren’t rising; they are reshaping the skyline of the city. Your next chapter in portfolio success is waiting.

Written By Rachna Rajput