As of September 8, 2025, Bitcoin (BTC) trades near $110K after weaker U.S. jobs data dragged Treasury yields and the dollar lower factors that usually support crypto markets. Yet analyst Plan C warns that a Q4 halving isn’t automatic; historical trends show mixed outcomes, so seasonality alone is not a reliable signal.

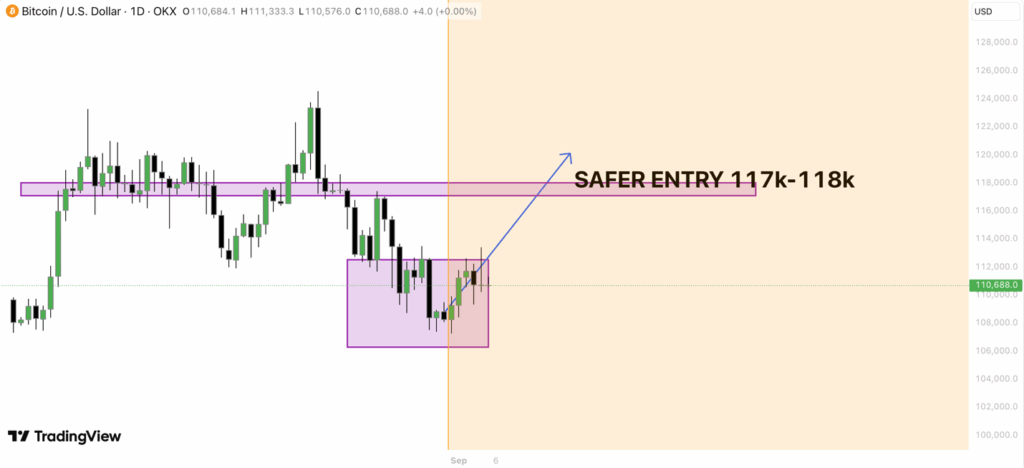

In this bitcoin price prediction, confirmation remains the focus: defend $110K–$112K and then reclaim $117K–$118K with volume, and the door to higher moves opens; lose that floor and the setup leans toward chop or deeper retracement. In that case, many traders look to rotate into altcoins offering better upside, with fresh breakout patterns and cleaner risk–reward.

The big question is: will the next big leg come from BTC dominance, or is rotation into alternatives the smarter play right now?

Bitcoin News: Jobs Data Fuels Fed Cut Bets

The macro environment for bitcoin just brightened: the latest U.S. jobs report showed slower hiring, a rising unemployment rate, and negative revisions. This sent Treasury yields lower, pushed the dollar index down about 0.70%, and lifted expectations for a September Federal Reserve rate cut.

Easier policy usually helps BTC by weakening the dollar and reducing funding costs, which cuts downside risk even if Q4 enthusiasm fades. As one strategist noted, “labor-market weakness gives the Fed room to cut.” A dovish Fed can stabilize Bitcoin, but traders still want confirmation on the chart before leaning bullish.

Sources: U.S. BLS Employment Situation, Aug 2025, Reuters Instant View, Reuters Dollar Reaction, Reuters Fed Cut Expectations.

Sources: BLS Employment Situation — Aug 2025, Reuters: Instant View, Reuters: Dollar falls sharply after jobs data, Reuters: Investors look for more aggressive US rate cuts.

Bitcoin Price Prediction Levels

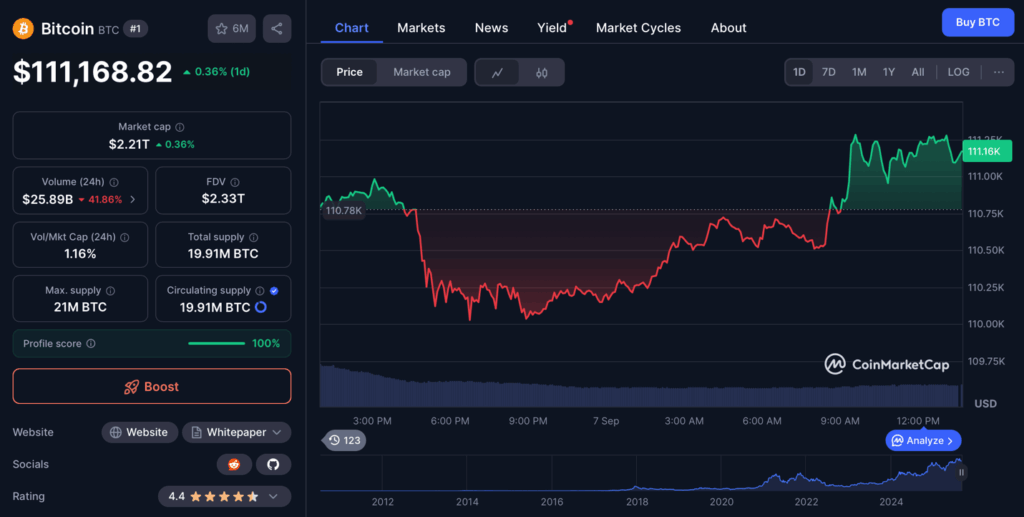

BTC is currently consolidating inside a $110K–$112K support band after its sharp retrace, with repeated wicks suggesting dip-buying even while momentum stays muted.

Source: Coinmarketcap

If buyers protect this range and a strong daily close holds inside or above the zone, or if BTC clears $117K–$118K on convincing volume, then $117K–$118K becomes the first upside target with scope for higher gains if momentum builds further.

Source: TradingView

But if the range fails on a decisive close, the door opens to $108K–$106K, with potential liquidity grabs into $103K–$101K. In short, this zone remains critical: it offers a tactical entry for medium-term bulls, but confirmation beats trying to catch a falling knife.

Why Rotate Now, And Is Pepeto Presale the Best Bet?

With the bitcoin price still stuck near $110K and no clear breakout yet, an altcoin rotation strategy can improve risk–reward. The idea: move part of a position from sideways BTC into coins showing stronger setups, visible catalysts (launches, protocol upgrades, adoption), and breakout potential, while still anchoring with Bitcoin. One candidate drawing attention right now is Pepeto, does it fit the criteria?

Pepeto (PEPETO) is positioned as a promising rotation choice. Its token powers PepetoSwap, a zero-fee exchange with no listing charges, designed to make token launches and trading cheaper while routing incentives through PEPETO. Alongside, it supports a cross-chain bridge enabling users to move assets and liquidity across networks within the app, broadening reach and deepening order flow.

Staking currently offers around 231% APY, attracting early adopters and helping to lock liquidity so markets remain stable post-listing. Momentum is strong: the presale has raised more than $6.6M already, with only a small allocation left, priced at $0.000000152 at the current stage and set to climb as each round fills.

While the bitcoin price holds in consolidation, projects with clear utility and fast-building traction often lead the next run, and today Pepeto stands out as one of them. Join The Presale At Official Website: https://pepeto.io