Dogecoin’s 2021 explosion still haunts the dreams of crypto traders: what if you’d held on? Fast forward to today, and some believe we could see a repeat, at least in magnitude, for a newer project.

In this piece, we’ll dissect DOGE’s past, set a realistic mid-term forecast, and then pivot to that “new crypto” hoping to channel the same kind of upside, especially by 2027.

Dogecoin (DOGE)

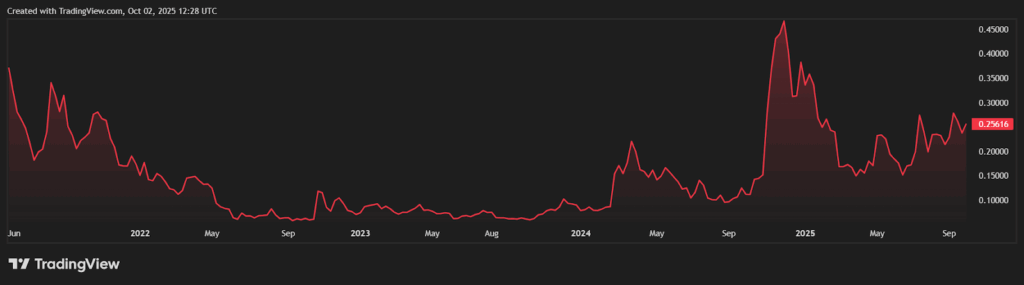

At present, DOGE trades near $0.25–$0.28 USD. Its market cap hovers around $35–40 billion. Its most famous run came in 2021, when meme energy, Elon Musk mentions, and speculative mania combined.

Dogecoin’s price peaked at roughly $0.74 in May 2021. That represented a phenomenal leap from its earlier baseline, on the order of over 10000% when measured from sub-cent levels. But that run was driven largely by hype, community coordination, and social momentum, factors notoriously hard to repeat, especially now with so much scrutiny and competition.

Because Dogecoin’s supply is extremely large and its utility minimal, sustaining a similar surge today would demand massive capital inflow and renewed speculative zeal. Given market maturity and competition, such magnitude is less plausible now.

That said, more modest gains are not off the table. A 150–175% increase over the next 12–24 months, doubling or nearly tripling from current levels, is within the spectrum of what meme-coin momentum might still deliver if sentiment revives.

New Crypto That Could Echo DOGE’s Move

Mutuum Finance (MUTM) is a DeFi protocol purpose-built for lending and borrowing, with demand mechanics embedded into its architecture. Running on Ethereum in a non-custodial model, the protocol ensures that users always retain control of their assets while every action on the platform, whether it’s supplying liquidity, borrowing against collateral, or staking tokens, feeds directly back into MUTM’s demand cycle.

The presale has followed a carefully structured trajectory. Launched in early 2025 at just $0.01 in Phase 1, MUTM has since advanced through multiple phases, now standing at $0.035 in Phase 6. That translates into 250% appreciation for the earliest participants, while still offering fresh entrants a clear pathway toward gains with the $0.06 listing price fixed in the roadmap.

To date, Mutuum Finance has raised more than $16.8 million, allocated over 740 million tokens, and built a community of 16,700 holders, a scale that demonstrates both momentum and trust.

MUTM vs DOGE

In the short run, Mutuum Finance (MUTM) has several advantages that Dogecoin (DOGE) no longer enjoys. One of the most notable is its commitment to launching a working beta platform at the exact moment the token lists. This means holders will not be left waiting for months to see functionality; instead, they can immediately begin supplying assets, borrowing, and staking, generating real activity and volume from day one.

Another advantage lies in its dual lending markets. The protocol will support both Peer-to-Contract (P2C) pooled markets for mainstream assets such as ETH and stablecoins, as well as Peer-to-Peer (P2P) isolated agreements for higher-risk or less liquid tokens. This combination creates flexibility by serving multiple use cases while ensuring that the wider ecosystem remains insulated from the risks associated with volatile assets.

Once these mechanics gain adoption early and are supported by exchange listings that provide liquidity, analysts believe MUTM could realistically establish a trading range of $0.20 to $0.30 within its first 6 to 12 months of launch. This would place it well above the official listing price of $0.06, while still requiring steady traction to unlock its full potential.

Mid-Term Drivers

For the mid term, Mutuum Finance (MUTM) shows its real strength through the way incentives are built into the protocol. Liquidity providers receive mtTokens, which not only accrue interest but can also be staked in the safety module. This creates multiple layers of utility and encourages users to remain active, locking liquidity into the system rather than treating the token as something to flip quickly.

Another powerful mechanism is the buy-and-distribute model. A share of protocol fees is used to purchase MUTM directly from the open market, and those purchased tokens are then redistributed to mtToken stakers. This design creates a self-reinforcing loop where increased platform activity naturally leads to more buy pressure and higher rewards, aligning user participation with token value growth.

Once adoption builds steadily and users continue to engage with these mechanics, analysts suggest that a mid-term valuation in the range of $0.60 to $1.00 is realistic under bullish execution. From today’s presale price of $0.035, that represents 10x to 30x upside potential, a figure that underscores why investors see MUTM as more than just another DeFi presale.

Long-Term Catalysts & Supportive Structure

Looking ahead to 2027, the larger drivers of Mutuum Finance (MUTM) start to come into focus. One of the most anticipated milestones is the launch of an overcollateralized stablecoin, which would provide the ecosystem with its own native unit of account. By anchoring liquidity internally rather than depending entirely on external stable assets, this step could deepen lending and borrowing activity while creating a more self-sustaining economy.

Equally important is the plan to expand onto Layer-2 networks. Lowering transaction costs and reducing friction is key for frequent interactions such as lending, rebalancing, and refinancing. By scaling in this way, Mutuum Finance could open the door to far greater adoption, as users who might hesitate at high fees on Ethereum would have a smoother entry point on faster, cheaper networks.

When these factors converge, stablecoin adoption, active staking, expanding usage, and secure scaling, analysts suggest MUTM could realistically enter the $1.50 to $2.00 range by 2027. That kind of appreciation would rival the percentage multiples seen during Dogecoin’s early surge, but with the critical difference that MUTM’s growth would be rooted in structural utility rather than sentiment alone.

Final Thoughts

The project has already completed a CertiK audit with a strong 90/100 Token Scan score and launched a $50,000 bug bounty across multiple reward tiers to ensure rigorous third-party testing. Transparency has been another focus, with a live presale dashboard, contributor leaderboards, and a $100,000 community giveaway helping to build trust well before mainnet launch. These measures give Mutuum Finance (MUTM) a foundation of credibility that many early-stage projects lack.

Dogecoin’s 2021 surge was remarkable, but replicating that kind of parabolic move under current market conditions is unlikely. Analysts view a 150–175% rise as far more realistic than another 10,000% run.

Mutuum Finance, however, positions itself differently. Instead of chasing cultural momentum, it is constructing the infrastructure for lending and borrowing in DeFi, creating demand through mechanics like dual markets, staking, and fee redistribution. This structural approach gives it the potential for sustained appreciation where meme coins depend only on sentiment.

For more information about Mutuum Finance (MUTM) visit the links below:

- Website: https://www.mutuum.com

- Linktree: https://linktr.ee/mutuumfinance