Best Monopoly Stocks in India: How many Indian companies can you name that are monopolies? Today we identify one of Warren Buffets’ favorite categories i.e. monopolies, but in the Indian markets. Monopoly refers to the category of companies who due to their major competitive advantage are market leaders in their industry.

These companies are very difficult to compete with and maintain the highest market share for their products and services.

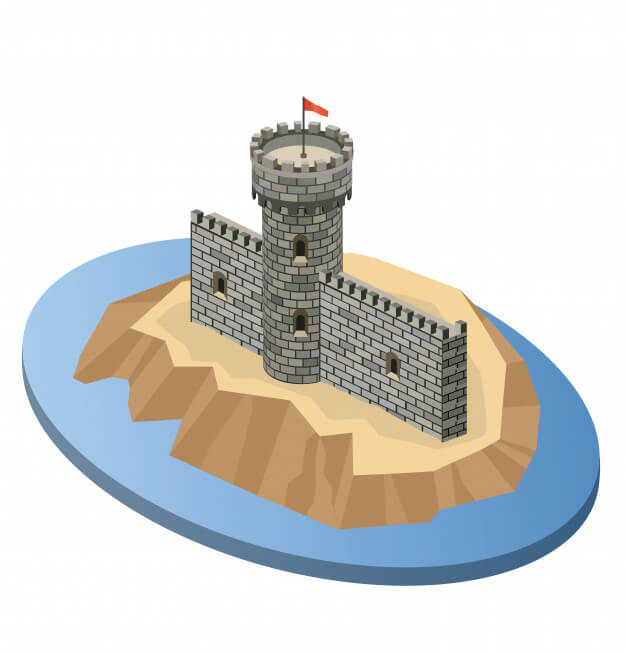

In investing, however, the stocks of these companies are known as MOAT stocks. A Moat is a hole that used to surround Medieval castles. This was done as a defense measure in order to make it harder for invaders to attack the castle. The wider and deeper the moat, the more protected the castle is.

In the business world, these Moats are either barriers to entry like huge capital, government restrictions, or business advantage that a company has made it hard to compete with them.

Today, we take a look at the Best Monopoly Stocks in India that have Conquered the Industry. There are market leaders in their industry with zero or very less competition. Let’s get started.

Table of Contents

10 Best Monopoly Stocks in India

Following is the list of monopolies in the Indian markets i.e. the companies that enjoy the status of being a monopoly: (Company – Market Share)

Best Monopoly Stocks in India #1 – IRCTC – 100%

IRCTC is a state-owned entity and the only player in the Indian markets that operate in the Industry. This makes it a monopoly as consumers have no other alternative. The company was founded in the year 1845.

It is one of the largest railways in the world and is one of the world’s largest employers. Rail networks are generally considered as ‘ Natural Monopolies’. This is because only one train can use the rack at a given time.

However, countries like the UK have bought in private players by allowing them to bid for rail lines. Earlier this year India too announced that it will be opening the sector for players.

Best Monopoly Stocks in India #2 – HAL – 100%

Hindustan Aeronautics India Limited represents the Indian aviation industry and plays a very important role in the Indian defense sector. The company a set up in 1940 by Walchand Hirachand and the Government of Mysore, with the aim of manufacturing aircraft in India.

Today the company is state-owned and is associated with designing, fabricating, and assembling aircraft, jet engines, helicopters, and their spare parts.

Best Monopoly Stocks in India #3 – Nestle – Cerelac – 96.5%

Cerelac is the brand of instant cereal made by Nestle for infants 6 months and older as a supplement for breast milk. Nestle is one of the worlds leading nutrition, health, and wellness company which was set up in 1866 in Switzerland.

It has spent more than a century in the Indian markets over the years has become an undisputed market leader in the baby food segment. It has an undisputed market share of 96.5% despite functioning in an open to all industry.

Best Monopoly Stocks in India #4 – Coal India – 82%

Coal India Limited is a coal mining and refining company. It is also the world’s largest coal-producing company in the world. It is owned by the Union government of India and is managed by the Ministry of Coal. The company contributes up to 82% of the total coal production in India. It was only this year that the government announced that the coal sector would now be opening up for commercial mining possibly ending its monopoly in the future.

Best Monopoly Stocks in India #5 – Hindustan zinc – 78%

Hindustan Zinc Ltd. is the world’s second-largest zinc-lead miner and holds a 78% market share in India’s primary zinc industry. The company was incorporated as Metal Corporation of India in 1966 as a Public sector undertaking. Today the company is a subsidiary of Vedanta Limited which owns a 64.9% stake in the Company while the Government of India holds a 29.5% minority stake.

ALSO READ

Best Monopoly Stocks in India #6 – ITC– 77%

Although the company has diversified into a conglomerate in the last century. Despite this, its cigarette business still holds 77% strong position in the Indian markets. This can be attributed to the expertise the company has developed in the field and a willingness to develop products to match the evolving taste of different types of consumers.

ITC’s wide range of brands includes Insignia, India Kings, Classic, Gold Flake, American Club, Navy Cut, Players, Scissors, Capstan, Berkeley, Bristol, Flake, Silk Cut, Duke & Royal. Apart from market experience, another advantage that the brand has is its supply chain and distribution network which spans across the country.

Best Monopoly Stocks in India #7 – Marico – Oil Products – 73%

Marico is one of the well-known FMCG companies in India but the majority of its success lies in its two brands ‘Saffola’ and ‘Parachute’. The company has come a long way in the segment despite being around for only 3 decades. Safola which competes in the premium refined edible oil segment has maintained its market leadership with a share of 73%. ‘Parachute’ on the other hand holds a market share of 59%. These also form up to 90% of their income.

Best Monopoly Stocks in India #8 – Pidilite – 70%

Pidilite’s product range includes adhesives and sealants (Fevicol and M-seal), construction and paint chemicals (Dr. Fixit), automotive chemicals, industrial adhesives, and industrial & textile resins. It is the leader in the adhesive and industrial chemical market with a market share of 70%.

Best Monopoly Stocks in India #9 – CONCOR – 68.52%

Container Corporation of India Limited (CONCOR) is a Public Sector Undertaking managed by the Indian Ministry of Railways. The company was set up in 1966 with the aim of containerizing cargo transport in the country. Concor’s core businesses include that cargo carriers; terminal operators, warehouse operators & MMLP operations. They hold a market share in domestic business of 68.52% in 2019-20.

Best Monopoly Stocks in India #10 – BHEL

BHEL is India’s largest engineering and manufacturing enterprise in the energy and infrastructure sectors and also a leading power equipment manufacturer globally. Its services and products range from power-thermal, hydro, gas. Nuclear and solar PV, transmission, transportation, defense & aerospace, oil & gas, and water. It also holds the single largest market share in the emission control equipment business in India

ALSO READ

Closing Thoughts

In this post, we discussed the list of Monopoly stocks in India that have conquered the industry. For a value investor, a monopoly or big Moat stock is similar to a gold mine. This is because if one can find a suitable Moat stock to invest in they provide significant returns in the long turn. But investors must watch out as these stocks just like other Blue Chip companies are generally overvalued and can lead to lower returns or losses.

That’s all for the post on “Best Monopoly Stocks in India“. Let us know which other Indian companies enjoy a big monopoly in their industry in the comment section. Have a great day and Happy Investing!

Frequently Asked Questions (FAQs)

- Which are the monopoly shares in India?

Some of the monopoly shares in India are IRCTC, HAL, Nestle, Coal India, Hindustan Zinc, ITC, Marico (Oil Products), Pidilite, Concor, and Bhel.

- Are there monopolies in India?

Yes, there are a few monopolies in India, like IRCTC with a 100% market share. There are a few other companies that have a huge market share like IEX has 95% of short-term electricity contracts in India and CAMS which has more than 70% of the market share, especially after Karvy was suspended from membership.

- How many manufacturers are there in a monopoly?

In a monopoly, there is a single-player/business that produces and sells a product in a given territory. The entry of another business is very difficult if there is a monopoly related to any product or service.

- Is the Indian Railway a monopoly?

Yes, the Indian Railway Catering and Tourism Corporation (IRCTC) or the Indian Railways is a monopoly with a 100% market share. It is a state-owned entity and the only player that operates railways in India. Earlier this year India announced that it will be opening the sector for players, just like the UK.

- Why are power companies monopolies?

Generation and distribution of electricity is an expensive business to be in. If economies of large-scale production are used, the benefits can be passed on to consumers. The costs involved are gargantuan and once a business gets the hang of it, each additional unit of electricity costs very little, thereby reducing the variable costs. One company with reduced costs is in a better position to charge less from a consumer, than having multiple players who try very hard to reduce fixed and variable costs.

- What are the 4 types of monopoly?

The four types of monopolies are:

- Natural Monopolies: It is a situation where it is best for one business to make a product.

- Geographic Monopolies: This happens due to the absence of sellers in a geographical location.

- Government-Sanctioned Monopolies: They are set up by the government and private players are not allowed to enter.

- Technological Monopolies: When a single firm has exclusive rights over the technology used to manufacture a product.