Understanding SXG Nifty meaning & its impact on Indian share market: If you are an active stock market trader in India, I’m sure that you would have definitely have heard of the term ‘SGX Nifty’. If you open any business news channel, then before the opening of the Indian equity market, all you will see is an hour-long discussion on the SGX Nifty and its implications on the opening of the Nifty for that day.

The importance of understanding this terminology can be seen from the fact that it is one of the most popular hashtags followed or searched over different social media platforms like Twitter, if one wants to have a better picture of the Indian Equity market. In this post, we are going to discuss what exactly is SGX nifty and how it affects Indian share market.

Table of Contents

What is SGX Nifty?

The word SGX is an acronym for the Singapore Stock Exchange. Further, Nifty is the benchmark index of the National Stock Exchange (NSE) of India and it is comprised of the top 50 companies listed on NSE. Overall, if we were to add these two constituents, we can say that SGX Nifty is the Indian Nifty trading on the Singapore Stock Exchange. It is an actively traded futures contract on Singapore Exchange.

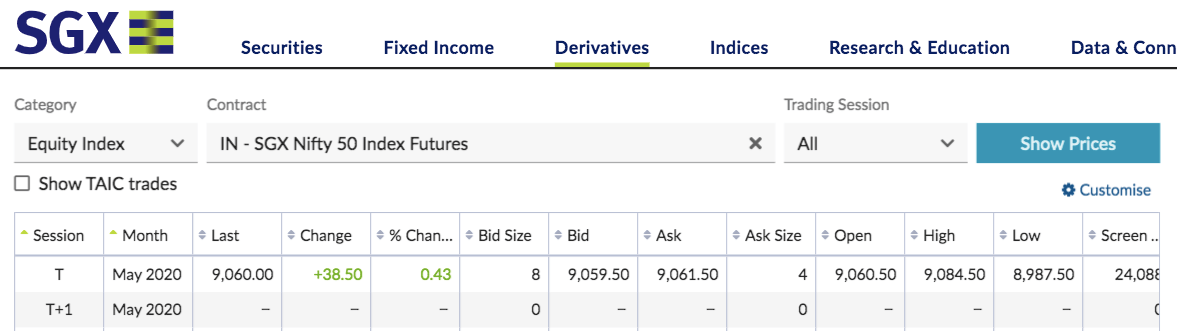

(Source: Sgx.com)

Who is allowed to trade SGX Nifty?

Any investor who is interested in trading Nifty, but is not able to access Indian Markets, finds trading SGX Nifty a very good alternative to trade. Even the big hedge funds who have big exposure in the Indian market find SGX Nifty as a good alternative to hedge their positions.

Further, an Indian citizen is not allowed to trade SGX Nifty contracts. For that matter, Indian citizens are not allowed to trade derivatives in any other country.

Difference between Nifty and SGX Nifty?

1. SGX nifty is Nifty futures contract trading in Singapore Stock Exchange and in India, Nifty contract trades on NSE.

2. The contract size of SGX Nifty is different compared to Nifty. In India, we have 75 shares in every Nifty contract Lot whereas the SGX nifty does not have a contract with shares in it. SGX Nifty is denominated in terms of US dollars. Say, if Nifty is trading at 9500, then the contract size of SGX Nifty will be 9500*(2 USD) i.e., 19000 USD.

For example, if the Nifty moves up by 100 points for the day, then make a profit of 100 rupees per share. Therefore, total profit in case of Nifty will be 100*75 = Rs 7,500. But in the case of SGX Nifty, we will be making a profit of 100*2 = 200 USD per contract.

3. Now, In India, in the case of Nifty, we see Open Interest as the ‘number of shares’ outstanding. But in the case of SGX Nifty the Open Interest shows the ‘number of contracts’ outstanding. Both Nifty and SGX Nifty are highly liquid and a very high volume of trading happens in that.

Also read: What is India VIX? Meaning, Range, Implications & More!

Trading Hours of SGX Nifty

(Source: SGX Nifty)

The above figure is the value of SGX Nifty from the website on the Singapore Stock Exchange. It shows the value of SGX Nifty futures traded on SGX. In Singapore Nifty trades in two tranches. One part during the day time and it is denoted by ‘T’ (as seen in the picture above). The other half during the evening time and it is denoted by ‘T+1’. The trades happening in the evening will be considered in the next day settlement prices.

(Source: SGX Nifty)

Now, the above picture gives you details about the trading hours of SGX Nifty. The Trading hours mentioned here are Singapore time and the difference between Indian Standard Time and Singapore time is 2 hr 30 minutes. Therefore, we can see that in the Morning (T) session, it trades from 9 am to 6:10 pm Singapore Standard time.

So, in Indian Standard time, the trading happens at SG Nifty from 6:30 AM to 3:40 PM. And the Evening (T+1) session, it trades from 6:40 pm to 5:15 am Singapore Standard Time, which if converted to Indian Standard time will have timings of 4.10 pm to 2:45 am.

Contract Settlements in SGX Nifty

SGX Nifty has two serial monthly contracts and it has Quarterly contracts. The contract expires on the last Thursday of Every expiring month and if the last Thursday is an Indian holiday, then it expires the preceding business day. The SGX Nifty contracts are cash-settled and the final settlement price is derived from the official closing of S&P CNX Nifty.

How SGX Nifty Impacts Indian Equity Market?

Looking at the current global scenario, with the continuous onslaught of COVID-19 pandemic or the rising tensions between US-China over trade deal, we see a continuous inflow of information and news. And these inflow of information has a direct impact on the Global Financial markets.

SGX Nifty still trading way after the closure of the Indian Nifty market, we see an impact of these global news on the SGX Nifty price movement. This further directly impacts the opening pricing of Nifty, the very next day. And that is one of the reasons we see the Indian Nifty market opening at a premium or discount over the previous day’s close.

Note: Many analysts use SGX Nifty as one of the factors to predict whether the Indian stock market will open higher or lower on a trading session.

Closing Thoughts

In this post, we explained what is SGX Nifty and its impact on Indian share market. The SGX Nifty is a perfect substitute for investors and traders looking to trade in the Indian equity market but are not able to do so. It is a perfect hedging instrument if you are already exposed to the Indian equity market.

One unique advantage that SGX Nifty has longer trading hours compared to the Indian Equity market. And all these points make it a lucrative investment and trading avenue.

Hitesh Singhi is an active derivative trader with over +10 years of experience of trading in Futures and Options in Indian Equity market and International energy products like Brent Crude, WTI Crude, RBOB, Gasoline etc. He has traded on BSE, NSE, ICE Exchange & NYMEX Exchange. By qualification, Hitesh has a graduate degree in Business Management and an MBA in Finance. Connect with Hitesh over Twitter here!