What is CDSL TPIN: The other day, I was opening my trading and Demat account with a discount broker. It took about 45 minutes since my documents were ready, and my father was surprised. He said that when he wanted to open his account, he had to visit a broker, submit documents and sign about 50 pages, of God knows what!

He said that most people would go to brokers that they knew, and sign on those 50 pages, without even reading them. After a few days, their account would be ready and they could start trading.

Some of the important components of this form, were the name declaration form, the power of attorney, the nomination form, details about the fees/charges/tariff, and so on. But thanks to technology we’re not stuck in this process.

However, as we enjoy these benefits while investing many of us must have come across the hassle of a CDSL TPIN while selling shares. In this article, we take a look at what this is so that you can find your way around it better! So Keep Reading to find out!

Table of Contents

What is Power of Attorney (POA)?

Before we jump into what the CDSL TPIN is let us understand what a POA is. In simple words, the Power of Attorney is a document that authorizes your stockbroker to debit shares from your account and to deliver them to the buyer. Many people would sign this form, even without reading it. Knowing this, a few stockbrokers started misusing it.

They started withdrawing securities even when their customers did not sell them, they started moving shares from one account to the broker pool account with the consent of the customer and they would scare customers to pay the credit (negative) to the broker from trading losses, using the Power of Attorney.

Image Source: Chittorgarh.com

A quick note: Earlier, the POA was mandatory, but now it is not. If a broker refuses to open your Demat account unless you sign the POA, it is a punishable offence.

When the SEBI (the Securities and Exchange Board of India) got to know about this, it changed its drafting norms and made sure that brokers could get only a limited purpose POA, authorizing them only to transfer securities and funds from clients’ Demat and bank accounts. SMS and email alerts were being sent to clients, but, that did not help.

What is CDSL TPIN?

Image Source: Zerodha

The CDSL (Central Depository Services (India) Limited) introduced the CDSL TPIN on 1st June 2020. It is an alternative to the POA. This TPIN is an additional 6 digit password that allows customers to authorize transactions.

This was created, managed and stored by CDSL. This was done in order to prevent brokers from misusing any POA. This TPIN is an alternate to the Demat Power of Attorney and is valid for 90 days after which, it has to be reset. However, the customer can reset it at any time.

Just like the POA, it authorizes a broker to withdraw shares from a customer’s Demat account. This authorization, however, remains valid only for one day, and for selected stocks for which it is given. This authorization can be cancelled at any time and users/customers can check the authorization status in the trading application.

The CDSL is a government-approved depository that holds customers’ Demat account and securities. Customers cannot interact with it directly, hence, they complete transactions with intermediaries called depository participants.

Stockbrokers are depository participants and members of the CDSL. Stockbrokers use a CDSL TPIN as a third party service in their trading software and cannot tamper with the CDSL TPIN illegally.

ALSO READ

What are the benefits of having a CDSL TPIN?

- It makes the Demat transactions safer by eliminating the limitations of the POA.

- When it comes to authorizing transactions, it gives the customer better control.

- If a client has not submitted the POA to his/her broker, then this PIN is required for every transaction.

- The CDSL TPIN is generated and stored by the CDSL, therefore, brokers cannot misuse or manipulate it.

- It makes the Demat account opening process paperless.

- TPIN gives better control over authorizing the transaction in a Demat account. Earlier, even if apps were used to open Demat accounts, the POA had to be submitted to complete the process.

How to use or generate the CDSL TPIN?

The CDSL TPIN can be generated and used through the following steps:

Step 1: Generation of the CDSL TPIN

Image Source: Zerodha

- Visit the CDSL website (cdslindia.com)

- Click on the ‘Generate- eDIS TPIN’ link that is seen on the right side.

- Enter your 16 digits Demat Account Number (BO ID)

- Then Enter your PAN Number and click ‘Next’.

- Enter the OTP received on your mobile, and the TPIN will be sent to you by SMS and email (from [email protected]).

- Remember this PIN, since it will be required to authorize transactions.

Step 2: Pre Authorization

Image Source: Zerodha

If you haven’t submitted the POA, you can pre-authorise the sale of your stocks at the beginning of each trading day. This will help you to execute transactions faster, rather than entering it each time you place a delivery sell order during the day.

- When you place a CNC (Cash N Carry) order, you will be asked to authorize the stock using the TPIN.

- Click ‘Continue’ and then you will be directed to CDSL’s page.

- A new page will open. Click on manage authorizations. Then select the stocks that you wish to authorise for selling, and continue.

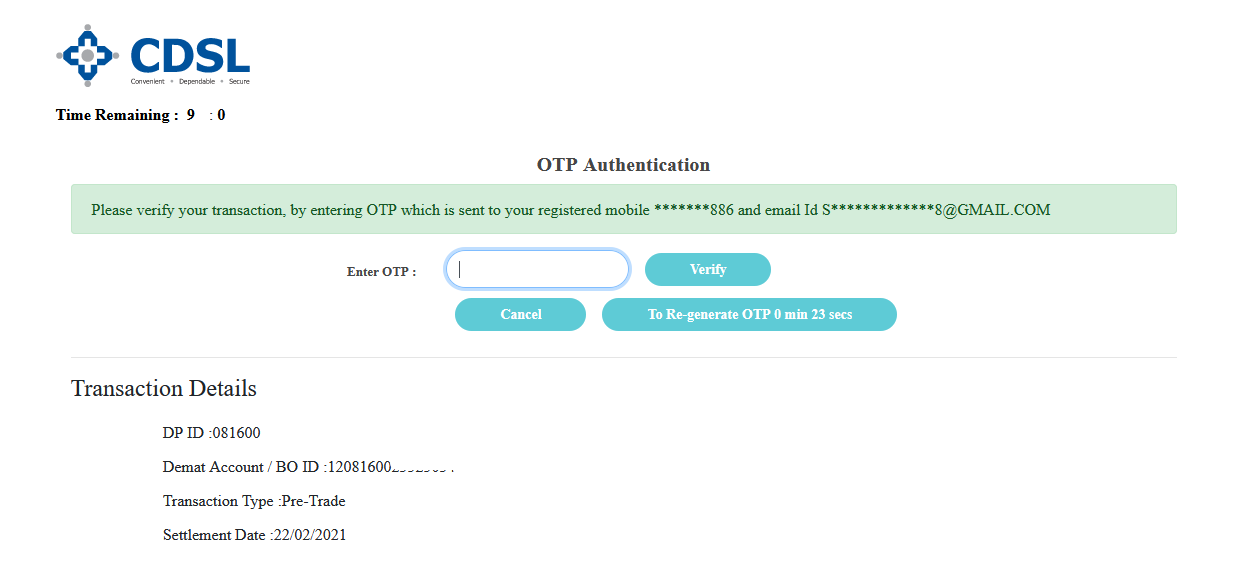

- Enter your CDSL TPIN and submit. You will receive an OTP on your registered mobile number and email ID.

- You will receive a confirmation message upon successful authorization.

- Now you can place a sell order.

- A maximum of 100 scrips can be authorized at once.

- It can be used even while placing After Market Orders (AMO).

CDSL TPIN and Mutual Funds

The CDSL TPIN can be used to authorize mutual fund redemption transactions as well. Authorizations are recorded from 8:00 AM to 5:00 PM and work in the same manner as stocks. Once the CDSL TPIN has been entered, it remains valid for redemptions that happen during the same day.

In Closing

When the POA was first introduced it had to be submitted only once, i.e., while opening an account. This made investing so much simpler since the customers would not have to enter anything except the login PIN for the app. And this PIN was used while selling, and in some cases, not even that.

However, It was prone to be manipulated and misused. Though the CDSL TPIN has to be entered every day, which can be quite a task for a few people, it tends to help users to keep better control with respect to what happens with their holdings.

As the old saying goes, It is always better to be safe than sorry! Let us know what you think about this article and also let us know if you found it helpful. Happy Investing!

You can now get the latest updates in the stock market on Trade Brains News and you can even use our Trade Brains Portal for fundamental analysis of your favourite stocks.